A Bayesian Approach to Data-Driven Insights

An eight-step mental model and statistical framework: Investors evolve their thesis with fresh signals. And data professionals can decode institutional investment decisions with Bayesian thinking.

Imagine a billiard table with a single white ball hidden somewhere on its surface. You can’t see the location of the ball, but you can roll red balls onto the surface and learn whether each lands to the left or right of the unseen white ball. Could you estimate the white ball’s position?

Surprisingly, you can, with just a handful of clues. This estimation puzzle, first outlined in 1763 by Thomas Bayes, is more than a party trick. It’s a powerful model for how investors and data professionals update their views as new evidence emerges—even if they never use the word “Bayesian.”

In this article, I’ll show how both investors and data teams already apply Bayesian thinking, why that matters for decision-making, and how an eight-step playbook (plus a live web game) can sharpen your approach—whether you’re making trades or building data products.

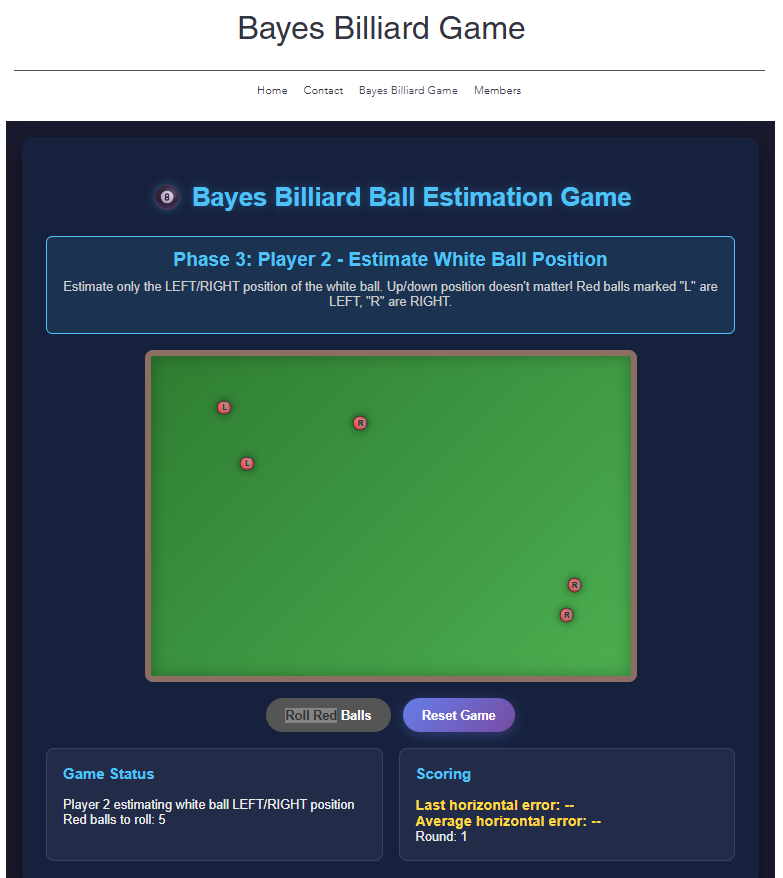

Let’s play the game:

To start, your best estimate is the center of the table—because, with no information, every location is equally likely.

The first red ball lands, and you learn it sits to the right of the white ball. Instantly, you know the white ball must be somewhere to the left of this red ball. The next red ball also lands to the white ball’s right, making you even more confident the white ball is leftward. If a red ball appears to the left, you adjust your estimate back toward the center. You keep updating, step by step.

This thought experiment first appeared in Bayes’ 1763 paper: https://royalsocietypublishing.org/doi/pdf/10.1098/rstl.1763.0053

Modern studies confirm that with just about five informative clues, you can locate the white ball with impressive accuracy. Here’s Professor Brian Cox and Sir David Spiegelhalter replicating the study.

Want to try it yourself? I’ve created a simple web game (vibecoded with Claude Sonnet 4, starting with a simple prompt and then about 20 minutes of refinement to add features) hosted on DataChorus.net, so you can see how Bayesian updating works in real time. https://www.datachorus.net/bayes-billiard-game

From Puzzle to Principle

That same logic drives every fundamental investment decision: start with a prior distribution and update as evidence comes in.

Establishing a baseline estimate and adjusting it as new information arrives is exactly how fundamental investors solve puzzles before the answers are fully reflected in market prices.

Embracing Bayesian principles can make investors more data-driven and help data companies better align their products with the outcomes their customers need.

Here’s what you’ll find in this article:

A primer on Bayesian statistics

How Bayesian methods connect with investing

How data teams and data companies can apply Bayesian thinking to their data products.

Welcome to the Data Score newsletter, composed by DataChorus LLC. This newsletter is your source for insights into data-driven decision-making. Whether you're an insight seeker, a unique data company, a software-as-a-service provider, or an investor, this newsletter is for you. I'm Jason DeRise, a seasoned expert in the field of data-driven insights. I was at the forefront of pioneering new ways to generate actionable insights from alternative data. Before that, I successfully built a sell-side equity research franchise based on proprietary data and non-consensus insights. I remain active in the intersection of data, technology, and financial insights. Through my extensive experience as a purchaser and creator of data, I have a unique perspective, which I am sharing through the newsletter.