Data Score Interview: What’s the Health of the US Job Market?

An interview of Live Data Technologies’ Director of Growth, Jason Saltzman, to learn what their granular data on employment reveals about underlying trends in the US job market

Welcome to the Data Score newsletter, your go-to source for insights into the world of data-driven decision-making. Whether you're an insight seeker, a unique data company, a software-as-a-service provider, or an investor, this newsletter is for you. I'm Jason DeRise, a seasoned expert in the field of alternative data insights. As one of the first 10 members of UBS Evidence Lab, I was at the forefront of pioneering new ways to generate actionable insights from data. Before that, I successfully built a sell-side equity research franchise based on proprietary data and non-consensus insights. Through my extensive experience as a purchaser and creator of data, I have gained a unique perspective that allows me to collaborate with end-users to generate meaningful insights.

In this issue of the Data Score Newsletter, we're testing out a new Q&A format. Our goal is to bring even more ideas and data-driven insights your way. This style allows us to dig into what data companies can really show us, highlighting the power of their data insights. This and future data provider interviews won’t be paid placements or act as an endorsement of one data vendor over another. Also, this is not investment research.

Interview Focus: Exploring the US Economic Health through the Lens of US Job Market Data

The most common question I hear from institutional investors is, “Where are interest rates heading?” The immediate next questions, underneath that big question, are: “When will inflation slow to the Fed’s target rate of 2%?” and “Will the economy be able to avoid a recession despite higher interest rates?” A key input into both of those questions is the health of the job market, which on the one hand is a driver of inflation via wage inflation and on the other hand could determine the ability for consumers to continue to spend, affecting the overall health of the economy.

To help understand the health of the US job market, I’ve asked Live Data Technologies’ Director of Growth, Jason Saltzman, four questions, which he kindly provided the answers to based on his company’s real-time human capital data. Live Data maintains a continuously updated database of the employment status of 90M+ professionals at 4M+ companies and provides data to multiple verticals, including as an alternative data source for investors across VC, PE, quantitative, and fundamental use cases.

If you would like to learn more, you can reach Jason Saltzman via LinkedIn or email at jsalt@livedatatechnologies.com.

And as always, feel free to reach out to me at jason.derise@datachorus.net

Now, let’s dive into the interview and the data

The Data Score: The US government reported that employment numbers remain strong relative to historic levels - What underlying trends do you see in your data that suggest this can continue, or are there signs that suggest future deterioration?

“On average, almost half of the professionals (those who were working a white-collar job) that were laid off in the last three quarters are still unemployed.” - Jason Saltzman

Jason Saltzman: Low unemployment may come at the cost of greater underemployment. Live Data is currently monitoring over 3 million former white-collar workers who are not currently, professionally employed by a company.

On average, almost half of the professionals (those who were working a white-collar job) that were laid off in the last three quarters are still unemployed. This number seemingly flies in the face of the current 20-month low in jobless claims or the 209,000 jobs that were added in June. But, this discrepancy tells us a lot about the jobs that former “white-collar” workers are finding.

To the BLS and other government entities that are tracking labor and employment, “a job is a job”. Many of the people that were let go from their white-collar roles are working non-professional jobs as they continue their search for their next career move. Put differently, these people are likely working jobs to make ends meet rather than professional jobs that match their previous experience.

While it is unclear how this trend will continue (we can report on real-time data, not predict the future… yet), it is clear that the knock-on effects of underemployment are a massive liability for both individuals and institutions. Underemployment will have both short-term and lasting impacts on earnings, savings, and spending for this cohort that had budgeted for a professional salary and has more than likely seen a reduction in income. At the next level up the economic hierarchy, this change in income and spending will have economic implications on tax revenue, real estate values, small businesses, etc.

Taking the extreme example of San Francisco, the widespread tech layoffs and people exodus have created an income and spending vacuum that has bludgeoned the city’s economy to a point where the city is almost unrecognizable compared to the pre-pandemic, boom-time era.

The Data Score: That sounds like the underlying trends are not as favorable. Is there any good news?

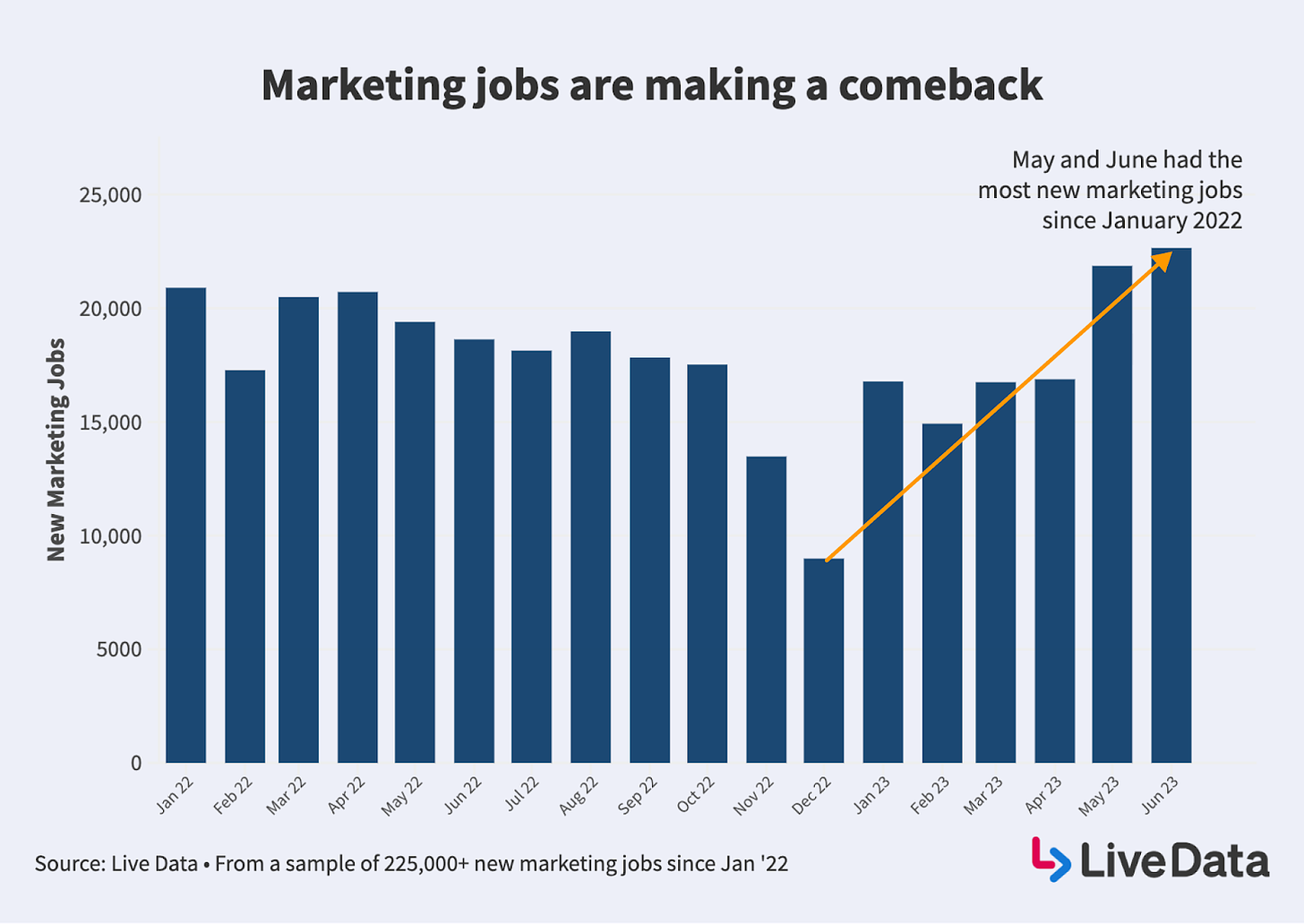

Jason Saltzman: The good news… Following the hiring freezes and layoffs of late 2022 and early 2023, new jobs are starting to rebound. In both May and June, the growth rate of new jobs for most functions was above January 2022 levels after an over 12-month slowdown.

With marketing being one of the functions most affected by corporate restructurings, the new job growth in May and June is a strong indicator of the general trajectory of white-collar roles.

The Data Score: That’s interesting about the marketing jobs reaccelerating. As a follow-up question, can you talk through how you created the sample of 225,000 new marketing jobs?

Jason Saltzman: Live Data continuously monitors the employment status of 90M+ individuals. This allows us to monitor granular job change events across dimensions including company change, title change, level change, industry change, and function change. To create the sample of 225,000+ new marketing jobs, I took a random sample of our database for people who had a job change into a marketing role (defined at the function level, including sub-functions like demand gen, growth, content, brand, etc.). The job change events included in the sample were both company changes and “same company” title, function, or level changes.

Example of a new marketing job via company change: Jane was a Marketing Manager at Acme Widgets and is now a Marketing Manager at XYZ Co

Example of a new marketing job via intra-company job change (promotion): Jamie was the Product Marketing Manager at ABC Co and is now the VP of Marketing at ABC Co

Example of a new marketing job via intra-company job change (function change): Alex was a Sales Development Rep at Fun, Inc. and is now the Content Marketing Associate at Fun, Inc.

Each of the three examples above is indicative of the types of new marketing jobs that make up our sample. Our sample counted all unique job change events, such that one person could have been represented multiple times if they had multiple job changes during our sample period.

The Data Score: You mentioned the situation in San Francisco and tech sector layoffs. Across the US, how has the cohort of laid-off tech workers in late 2022 and early 2023 fared in their return to employment?

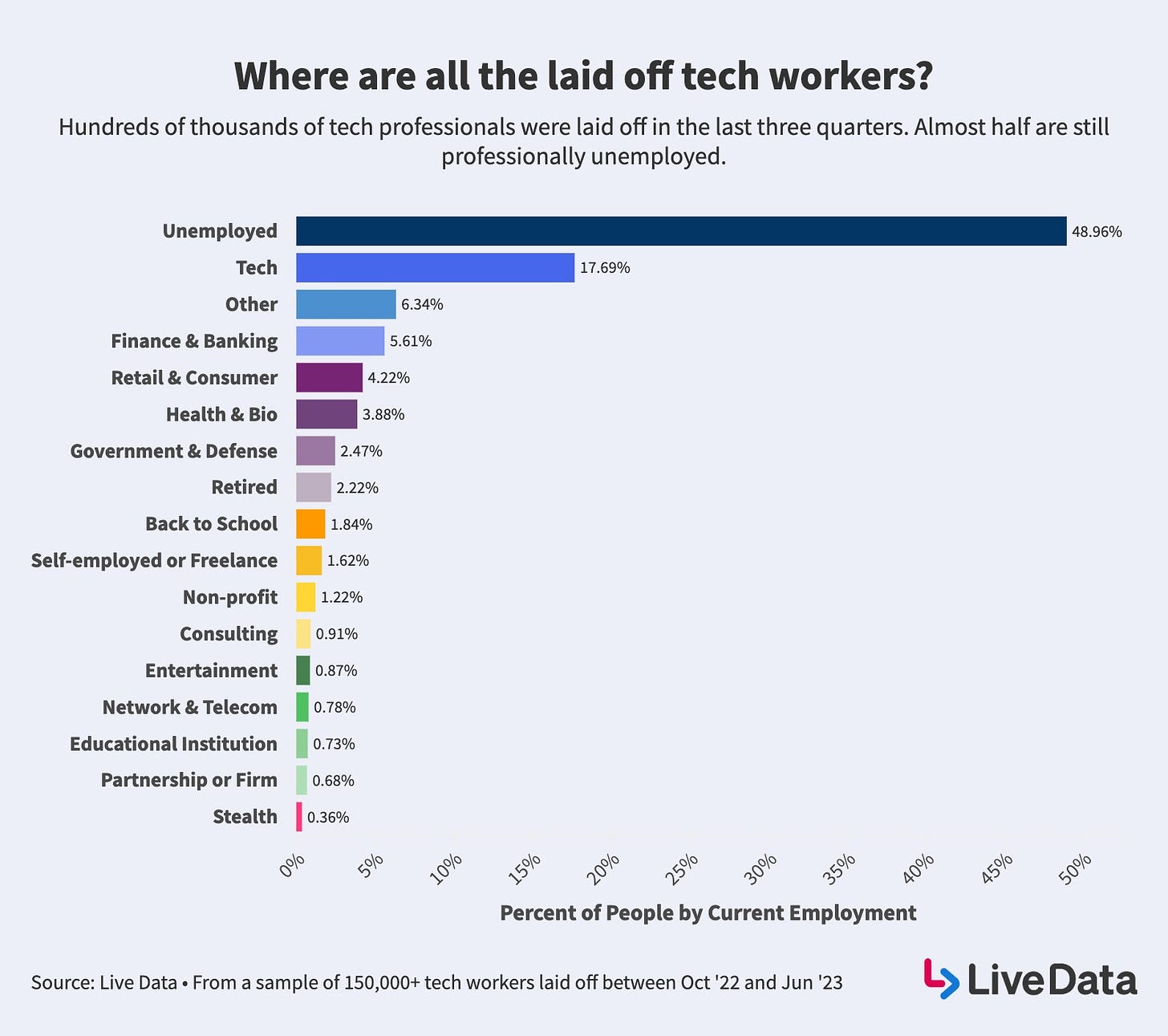

Jason Saltzman: Almost half of the employees that were laid off from companies of all sizes, stages, and sectors are still struggling to find their next professional role. ~49% of laid-off tech talent remains unemployed and only ~17% have rejoined the tech industry.

The data for tech workers is similar to that of any other industry and matches the re-employment rates for laid-off professionals from both startups and public companies.

Despite the challenges, there are some positive trends emerging. For those who managed to secure employment after being laid off, the majority have found new opportunities at the same or higher level than they were at previously (see: directors are still directors and VPs are still VPs).

Two other positive signals from the data are that unemployed tech employees are showing increasing signs of “betting on themselves”. Tech employees are ~1.5x more likely to join an early-stage startup or to start freelancing than employees from other established industries. In a similar vein, the rate of unemployed tech workers returning to higher education has increased versus previous years, showcasing a growing interest in upskilling or exploring new career paths.

Overall, laid-off tech workers fare decently in their return to employment when compared to those affected in other industries. However, the broader challenges of unemployment and underemployment are still creating massive headwinds for any professionals that were laid off in the last three quarters.

The Data Score: The last of the baby boomers are set to retire in the coming years. Has there been a shift in the data on baby boomers remaining in the workforce longer? If so, what kinds of industries are they participating in?

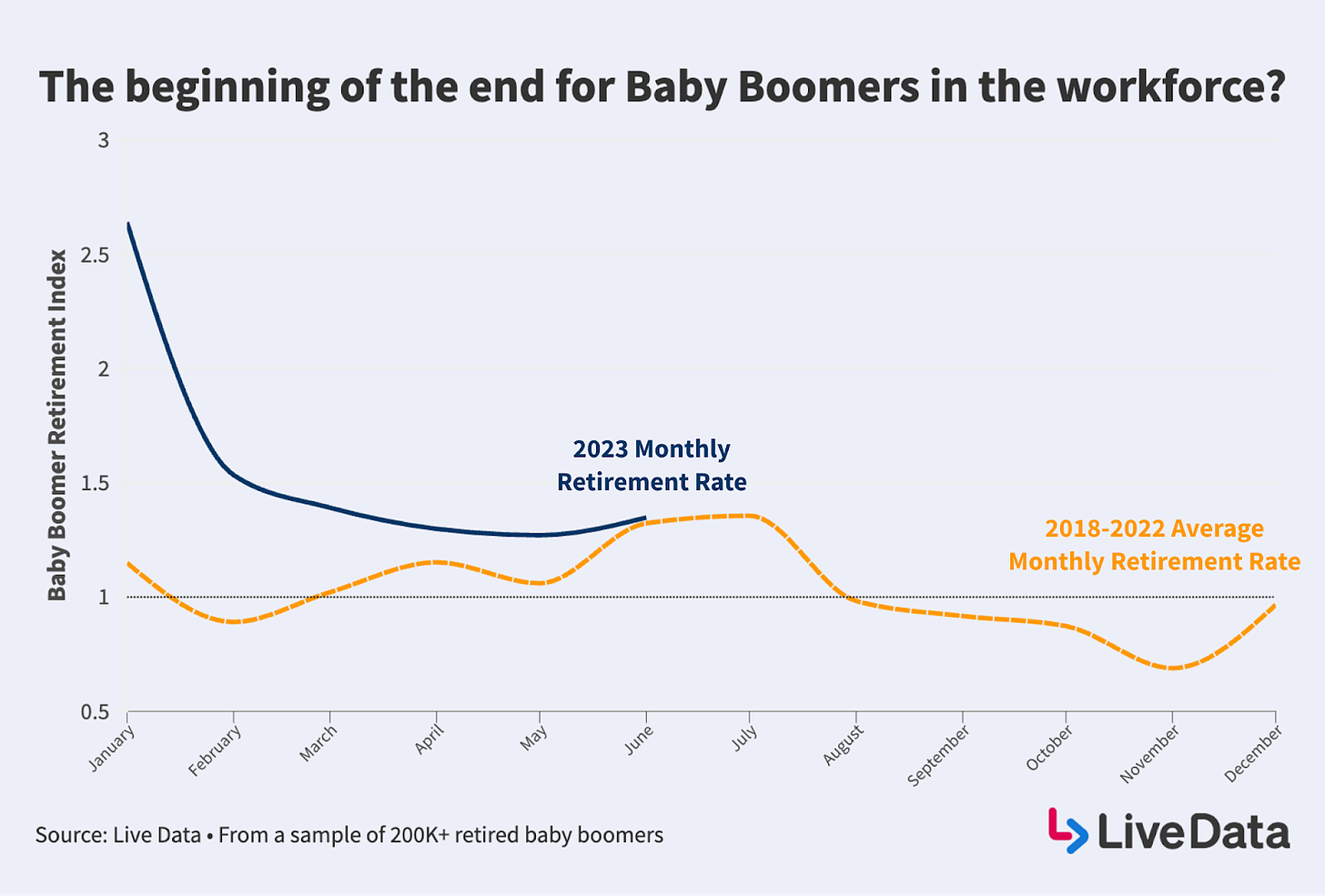

Jason Saltzman: From a sample of just under 1 million retired baby boomers, 2023 appears to be a tipping point for the generation’s remaining workers. Tens of thousands of boomers that remained in the workforce through the end of 2022 are now retiring in droves.

In January 2023, over 2.5x more baby boomers retired versus the 5-year average. The continued surge in retirement over the previous 6 months is indicative of an aging generation that is ready to exit the workforce after weathering the COVID-19 pandemic and the layoffs of late 2022.

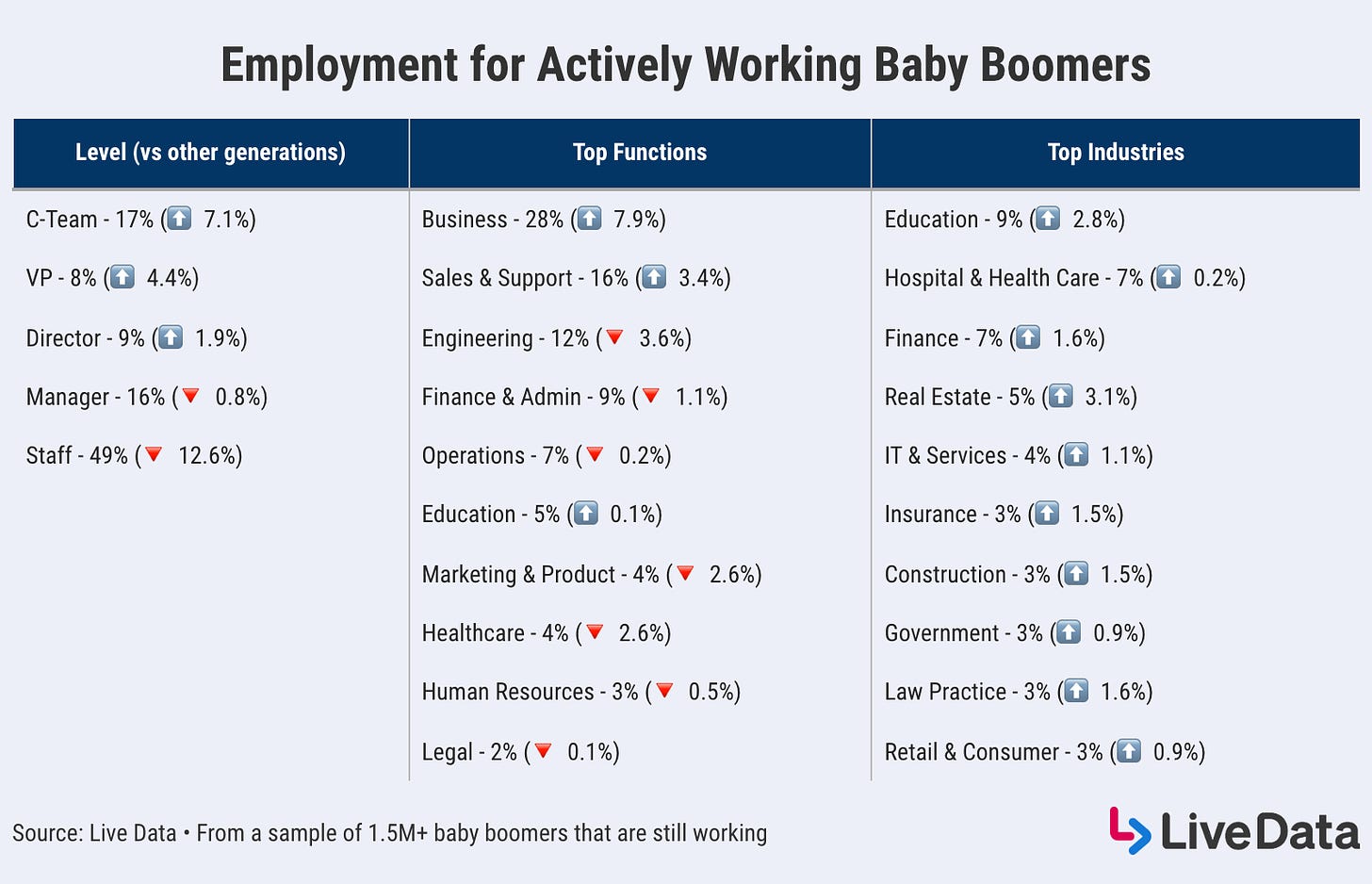

Of the millions of baby boomers that remain active in the workforce:

25% are in Executive roles (VP or C-team)

68% of baby boomers are employed in 25 industries (vs 47% employment across the top 25 industries for other generations)

Education and healthcare, two of the industries that are the most pro-social, are retaining the highest number of retirement-age boomers

The Data Score: As a follow-up question, can you talk about how you created the sample of 200,000 baby boomers who retired for the analysis?

Jason Saltzman: Our sample of 200,000+ retired baby boomers was created using two main criteria:

Must have a verifiable signal of retirement: Across our dataset, this signal is strongest at the company or title level. People who publicly announce their retirement generally will mark this in their title, company name, or in a public post.

Must have a strong signal that indicates they are a baby boomer: Across our dataset, this signal is present via first employment date and/or graduation date. For the individuals classified using their first employment date, we included people who had their first professional job between 1965 and 1985. For the individuals classified using graduation dates, we included people who graduated high school between 1964 and 1983 and/or graduated with an undergraduate degree between 1967 and 1987.

Where applicable, we cross-referenced both first employment and graduation signals.

The Data Score: What industries are seeing the fastest growth among Gen Z workers who are at the beginning of their careers?

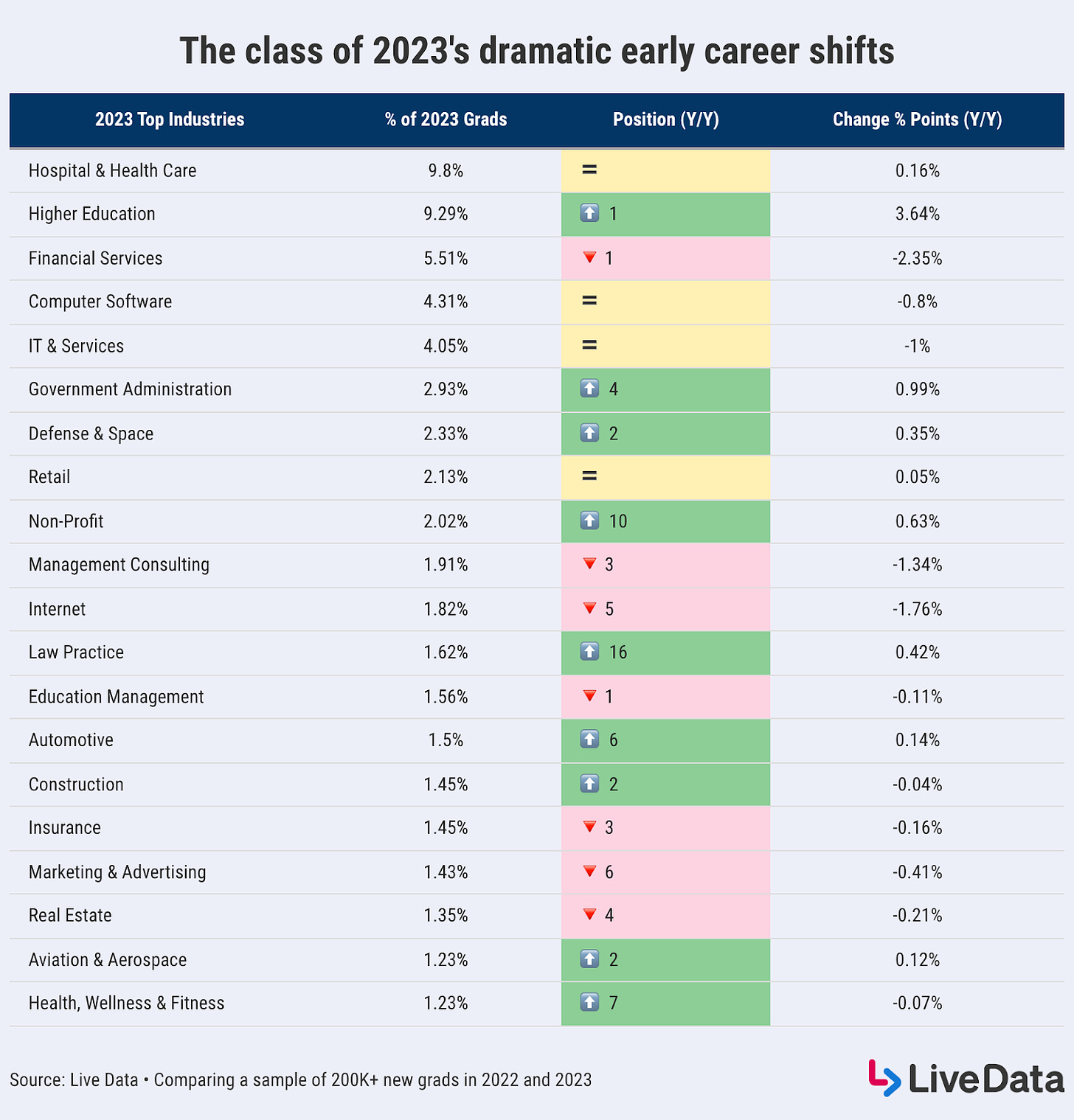

Jason Saltzman: The class of 2023 marks a significant shift in early career preferences. Traditional early career launch pads such as finance, tech, and consulting are failing to attract talent at the same rate. At the same time, early career moves to industries that have more pro-social or more “impactful” work are skyrocketing.

Last year, the post-grad jobs for the class of ’22 looked nearly identical to the previous 10 years — healthcare, finance, tech, and consulting drew the majority of grads. For the first time in almost a decade, there was a major shakeup in the industries attracting the graduating class.

Highlights from a comparison of 200k+ new grads across the last two graduating classes:

In 2023, 5.26% more new grads started in higher ed, government, or non-profit work versus 2022.

In 2023, more new grads are choosing grad school or research at an educational institution.

This year saw a categorical decrease (-7.25%) across new grad hiring in traditional hotbeds including finance, consulting, and tech.

The healthcare sector continues to attract the most new grads.

The Data Score: What is your take on why there is a step change in the industry popularity of new graduates?

Jason Saltzman: With continued socio-political issues and uncertainty around job security in multiple industries, it is no surprise that 2023 may be a tipping point for the industries and career paths attracting young talent. In a similar vein, the class of 2023 is the first class to have gone through the majority of their college career in the pandemic and post-pandemic world, and shifting career preferences may be one of the early indicators of the “long-term effects” of the pandemic.

The “other side of the coin” is that the traditional early career hotbeds were the industries that were most impacted by layoffs and restructurings in the last three quarters. Nearly every major finance, tech, and consulting company went through one or multiple rounds of layoffs and hiring freezes. This means that while many new grads may have been seeking employment in traditional industries, the employment opportunities weren’t there. If the big tech companies, big banks, and major consulting firms that normally account for large percentages of their respective industries’ new grad hiring were still restructuring during recruitment season, many of the talented early-career individuals were likely forced to look elsewhere to secure employment.

On Live Data’s website you can interact with the chart below.

Concluding thoughts

I’d like to thank Jason Saltzman for his willingness to try out this interview format. Let me know if you’d like to see more content like this, interviewing data companies about how their data can specifically answer questions that are on the minds of investors. If you are keen for more like this, let me know the future questions you’d like to see answered with data.

- Jason DeRise, CFA