Hot Take on Alternative Data

"It was all the rage that Alternative data was going to transform the industry. And, it's had a modest impact, which was, frankly, our prior back then" - Ken Griffin, CEO of Citadel

Welcome to the Data Score newsletter, your go-to source for insights into the world of data-driven decision-making. Whether you're an insight seeker, a unique data company, a software-as-a-service provider, or an investor, this newsletter is for you. I'm Jason DeRise, a seasoned expert in the field of alternative data insights. As one of the first 10 members of UBS Evidence Lab, I was at the forefront of pioneering new ways to generate actionable insights from data. Before that, I successfully built a sellside equity research franchise based on proprietary data and non-consensus insights. Through my extensive experience as a purchaser and creator of data, I have gained a unique perspective that allows me to collaborate with end-users to generate meaningful insights.

Ken Griffin, CEO and founder of Citadel, was interviewed by Raj Mahajan, global head of Goldman Sachs’s systematic client franchise, and posted to YouTube on June 29, 2023. The conversation shared many great points about risk management, education, AI's impact on white-collar work, closing the wealth gap, and the benefits of collaborating in person.

Approximately nine minutes into the discussion, the conversation shifted to a comparison between the value offered by alternative data and the insights gained from direct interactions with corporate management:

"It was all the rage that Alternative data was going to transform the industry. And, it's had a modest impact, which was, frankly, our prior back then. And the reason for [this] is most of your alternative datasets just do not have a richness of information that transcends [the information] that you have in management team interactions." - Ken Griffin CEO and founder of Citadel

Key takeaways:

Griffin's analysis of the current state of alternative data is astute and aligns with my previously expressed views, given the complexities involved in generating insights from data. Generating actionable insight from data is hard.

In the Data Score Newsletter, I've written about Alternative data being in the "trough of disillusionment" in the Garter HypeCycle paradigm. But there is a path to long-term success for alternative data. I wrote about it in “The Bull Case for Alternative Data” https://thedatascore.substack.com/p/the-bull-case-for-alternative-data

Data companies need to acknowledge that financial market professionals do not start with data and figure out its implications; they start with questions and work backward for answers. This means a data company isn't just competing with other data providers; they are competing with all available resources that can help answer crucial investment questions. That includes corporate management access.

Griffin's comment is not an indication that alternative data teams at Citadel are underappreciated or underutilized. The investment made in these teams indicates a clear ROI in deriving insights from alternative data. Citadel has demonstrated a unique capability for generating alpha from alternative data, creating a competitive edge for them.

For data companies:

Many investment firms have not yet invested sufficiently in data, technology, and expertise to extract ROI from alternative data on a large scale. I wrote about this in “Why some data companies struggle to sell to the financial markets” https://thedatascore.substack.com/p/why-some-data-companies-struggle

Data companies should be assessing the product from the point of view of their clients in terms of impact and effort. To engage asset managers beyond the top tier, data companies must align their products more closely with their clients' desired outcomes (impact) and ensure their data is easier to work with (effort).

For the financial markets:

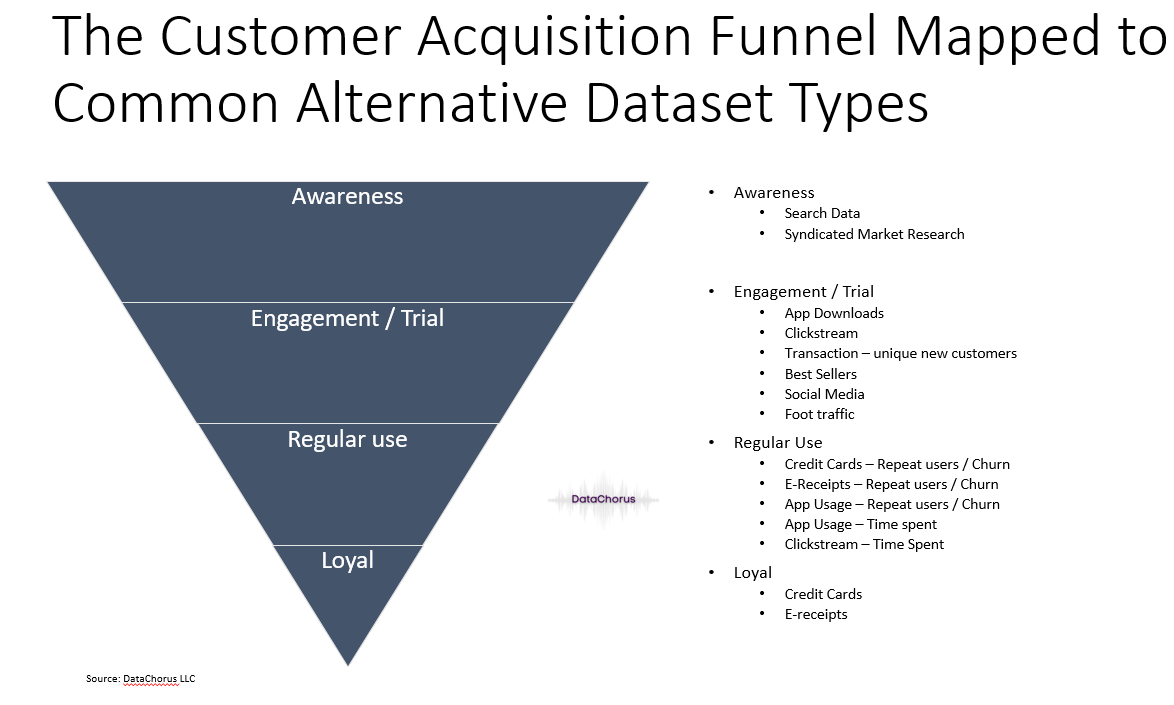

Consider a broader application of alt data by constructing detailed mosaics around the critical investment questions. This involves identifying where alt data is a beta measurement and where it presents alpha opportunities. For example, I wrote about one of the many approaches to solving important investment debates with data: A different approach to revenue estimates leveraging alternative data https://thedatascore.substack.com/p/a-different-approach-to-revenue-estimates

Leveraging centralized data and analytics product teams can result in scale, scope, and compliance economies, driving a high ROI. Thanks to technological advancements, this is more achievable now than five years ago. Alternative data doesn't have to be a competitive advantage exclusive to the largest asset managers.

The next step in your alternative data journey

The current challenges facing the Alternative Data industry are real, but it’s not the end of the story. I created DataChorus to break down silos between data, technology, and business decision-making to get to the good part: highly actionable and accurate decisions. Feel free to reach out to discuss these issues facing your company and team.

- Jason DeRise, CFA