The ROI of Data (Revisited)

One of the most popular Data Score articles remains highly relevant to data teams and data products, especially heading into 2026 roadmap and budget planning.

This classic Data Score article from January 2024 is still highly relevant to data buyers, internal data teams, and data product creators. Data on its own is a cost, not an asset. The value comes only when data is transformed into insight-ready products that inform economic decisions. Measuring the return on investment (ROI) of data requires linking datasets directly to decision-making impact.

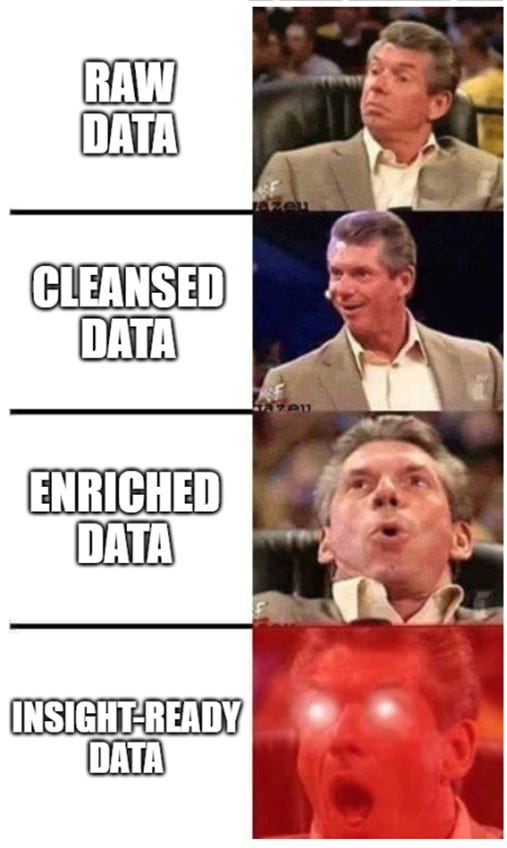

It is important to understand the difference between Data and insights. Simply ingesting data doesn’t create an advantage. Raw data is messy, noisy and has biases. Insights come from cleaning, enriching, and contextualizing data into trusted, usable metrics aligned with the decisions to be made.

Maximize ROI by reducing cost to insight: Even “free” data incurs costs in extraction, loading, transformation, and maintenance. There are key factors discussed in the article to properly understand the cost side of the equation which will help data companies better understand the work data buyers are doing to convert their raw data into value.

The article also uncovers the key drivers of the return part of the equation, exploring the impact in magnitude and breadth of coverage.

Caveats and Limitations are considered about variance and bias of datasets, which limit the potential for return or increase the costs

Data companies struggle to understand that the ROI of data shifts over time. Data that is valuable one year may lose relevance once the market absorbs its signal. Data buyer budgeting frameworks may lead to doubling down on data sets highly aligned with the most important investment debates of the moment or cutting datasets that provide an edge where there isn’t investment decisions to be made, or cutting datasets in favor of other datasets that better address the needs.

Here’s the full article, which I hope anyone who missed it the first time gets the benefits. And for those who have been with the Data Score for many years, it’s worth revisiting it as 2026 development roadmaps are considered.

Assessing the ROI of Data

Welcome to the Data Score newsletter, composed by DataChorus LLC. The newsletter is your go-to source for insights into the world of data-driven decision-making. Whether you're an insight seeker, a unique data company, a software-as-a-service provider, or an investor, this newsletter is for you. I'm Jason DeRise, a seasoned expert in the field of data-driven insights. As one of the first 10 members of UBS Evidence Lab, I was at the forefront of pioneering new ways to generate actionable insights from alternative data. Before that, I successfully built a sell-side equity research franchise based on proprietary data and non-consensus insights. After moving on from UBS Evidence Lab, I’ve remained active in the intersection of data, technology, and financial insights. Through my extensive experience as a purchaser and creator of data, I have gained a unique perspective, which I am sharing through the newsletter.

- Jason DeRise, CFA