Two-Minutes Ahead of the Future

An odd night in a Boston hotel bar watching the Knicks-Pacers game becomes a parable about data, confidence, and the danger of being early.

Watching the Eastern Conference Finals Game 1 in a hotel bar in Boston

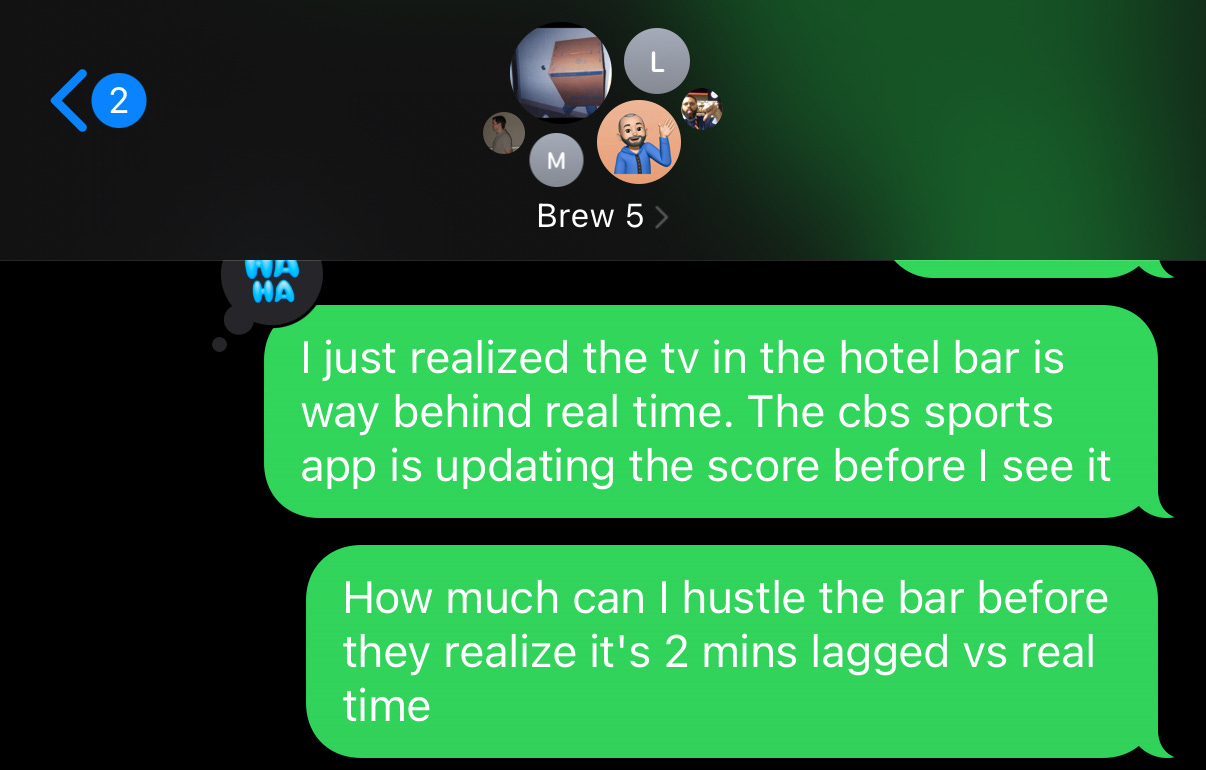

While watching the Knicks-Pacers Game 1 at a Boston hotel bar, I realized my phone was showing “the future.” I texted my college friends: “How much can I hustle the bar before they realize the TV is 2 minutes lagged versus real time?”

On Wednesday, May 21, I was in Boston for work and stopped into the hotel bar to catch Game 1 of the NBA Eastern Conference Finals between the Knicks and the Pacers. The game was well into the third quarter by the time I got settled in. It seemed many fellow New Yorkers were also staying at the hotel. Conversations about the next day’s meetings and pitches filled the air, with a healthy focus on what’s happening in the game. In a way, we were all trying to pretend this business trip didn’t land us in “hostile” sports territory. As an understatement, Boston sports fans don’t like New York sports teams!

Having not seen the beginning of the game, I didn’t have a sense of the momentum of the game and key drivers of the score. I opened up the CBS Sports app to check the stats of the game so far to get caught up (it’s the best sports app, don’t @ me).

That’s when I noticed it. The score was higher than what was on the TV. The app is usually way delayed versus real time. And even if the terrestrial broadcast was lagged due to regular latency, the app is usually updated after the TV feed. But it seemed like the bar had a satellite feed or an internet feed.

This meant the app wasn’t just slightly ahead—it was minutes faster than the TV feed.

As a household that’s “cut the cable,” I’m used to getting alerts telling me the outcome of sports before my streaming service gets to that “real-time” event. I often find out Fulham scored before I actually see it happen on the Peacock app. That kind of slow latency is the worst for a sports fan who has always had the illusion that the images they are seeing of the game are happening at the same time for everyone watching the game.

But this hotel bar, filled with New Yorkers, was cheering for the game like it was real time. As long as no one checked their phone, the game felt real-time inside this little pocket universe. The app and the game feed are lagged, with the app lagging less than the TV. To the audience, it would appear like I had perfect predictive powers of this Knicks-Pacers game.

I began testing the idea for a future article: how latency creates an edge

And of course I wasn’t actually betting on the outcome of each play. What I was doing was saying to the bartender, “Watch, he’s going to miss this 3, but then Brunson is going to hit a 3,” or “Watch Towns drive the lane and finish with a reverse layup.”

I decided to take screenshots and pictures, as this could make a great article about the importance of early signals in investing.

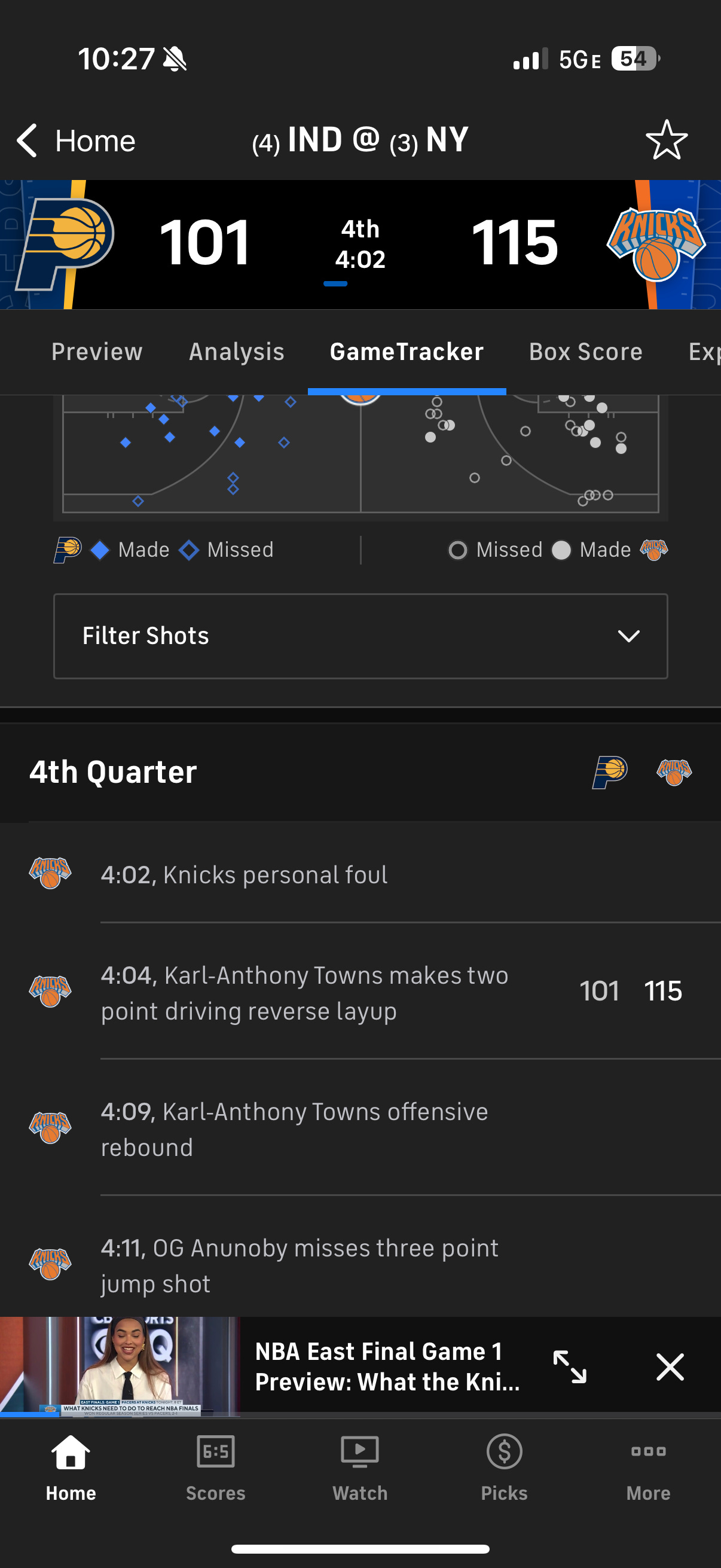

Sure enough, here’s Towns about to score the “predicted” layup.

What I didn’t realize at the time was that this moment—me, a phone, a bar full of Knicks fans—wasn’t just a quirky sports story. It was a metaphor. And in finance, that metaphor has a price tag.

Welcome to the Data Score newsletter, composed by DataChorus LLC. This newsletter is your source for insights into data-driven decision-making. Whether you're an insight seeker, a unique data company, a software-as-a-service provider, or an investor, this newsletter is for you. I'm Jason DeRise, a seasoned expert in the field of data-driven insights. I was at the forefront of pioneering new ways to generate actionable insights from alternative data. Before that, I successfully built a sell-side equity research franchise based on proprietary data and non-consensus insights. I remain active in the intersection of data, technology, and financial insights. Through my extensive experience as a purchaser and creator of data, I have a unique perspective, which I am sharing through the newsletter.

This is an entry in the Data Playbook, which is premium content from The Data Score, but I’ve decided to keep this article outside the paywall.

The importance of latency and early signals for investing

In investing, early data points come at a premium because timing drives opportunity. If you know something even slightly before the rest of the market, you can make plays that look like genius.

In the era of increasingly commoditized data, latency, the delay between when a signal is generated and when it’s consumed, remains one of the few truly durable edges in institutional investing.

Here’s why:

Latency unlocks alpha generation

Latency arbitrage is real. Whether it’s millisecond-level price changes on exchanges or early access to economic indicators through alt data, being first offers exploitable opportunities. But that edge decays fast. Markets adapt. Indicators propagate. And what was once alpha becomes noise. The investors who extract value are those who understand the window between signal and saturation.

It’s about speed relative to others in the market. In institutional investing, latency isn’t measured against the clock—it’s measured against the rest of the market. A 10-second head start is useless if everyone else has five. The key is being earlier than the consensus, not just early in absolute terms. Firms spend millions to co-locate servers not to reach market data before the competition.

Latency shapes strategic execution

Different strategies value latency differently. Quant funds running high-frequency models may require nanosecond-level data ingestion, while discretionary fundamental managers may benefit from daily (and potentially hourly) alternative data updates, so long as they’re ahead of the broader market narrative. Either way, latency shapes how the data is used, not just when.

But, relative speed without input quality is just faster mistakes

Accessing signal faster only helps if the data is trustworthy. Speed amplifies both value and error. Institutions must balance low-latency data with rigorous validation and governance frameworks. Otherwise, it’s just a faster way to lose capital with more confidence.

Regulatory and Risk Implications Are Rising. With the rise of AI-generated news and volatile geopolitical commentary, the cost of reacting to the wrong fast signal has never been higher. Regulators are watching. Risk teams are nervous. Latency matters—but traceability and auditability matter more.

The industry has come a long way in high frequency trading and correctly interpreting signals

If you want a case study in what happens when speed outruns comprehension in the markets, you don’t have to look far.

The Flash Crash (May 6, 2010)

The setup: The stock market plunged 9% within minutes, then recovered almost immediately.

The Signal Fail: High-frequency trading algorithms misread market data points, triggering a chain reaction. As algorithms responded to each other's selling, liquidity disappeared and prices crashed.

The Flash Crash taught the industry that speed without understanding is just automated panic. Protections have since been added with more governance and risk model compliance. That’s not to say that early data is always right; after all, one investor’s buy signal can be another’s sell indicator.

Today’s need for speed: A social media post can change the market trajectory in a second.

In today’s markets, geopolitical decision-making and communication can change the direction of the markets because the security level and industry-level trends can be upended by a macro policy change.

The markets are increasingly looking at ways to consume political social media posts in real time to convert the comments into sentiment indicators.

The faster you consume and interpret the tweet, the more alpha is possible.

That same race—the scramble to act before others—is exactly what I was replaying back at the bar. Except this time, it was Brunson and the Pacers instead of bonds and tariffs.

The Knicks game was heating up in the 4th quarter

Back at the bar, I kept up my latency experiment. I decided to let the bartenders in on the secret to their amusement.

As the game got closer to its finish, the Knicks were pulling away, and the crowd in the bar started to focus more on the game than on the next day’s meeting schedule. Then the Pacers started to make a comeback.

I continued to predict to the others watching the game what was going to happen, like, “He’s going to miss this free throw but make the next one,” and sure enough, it happened to their amazement.

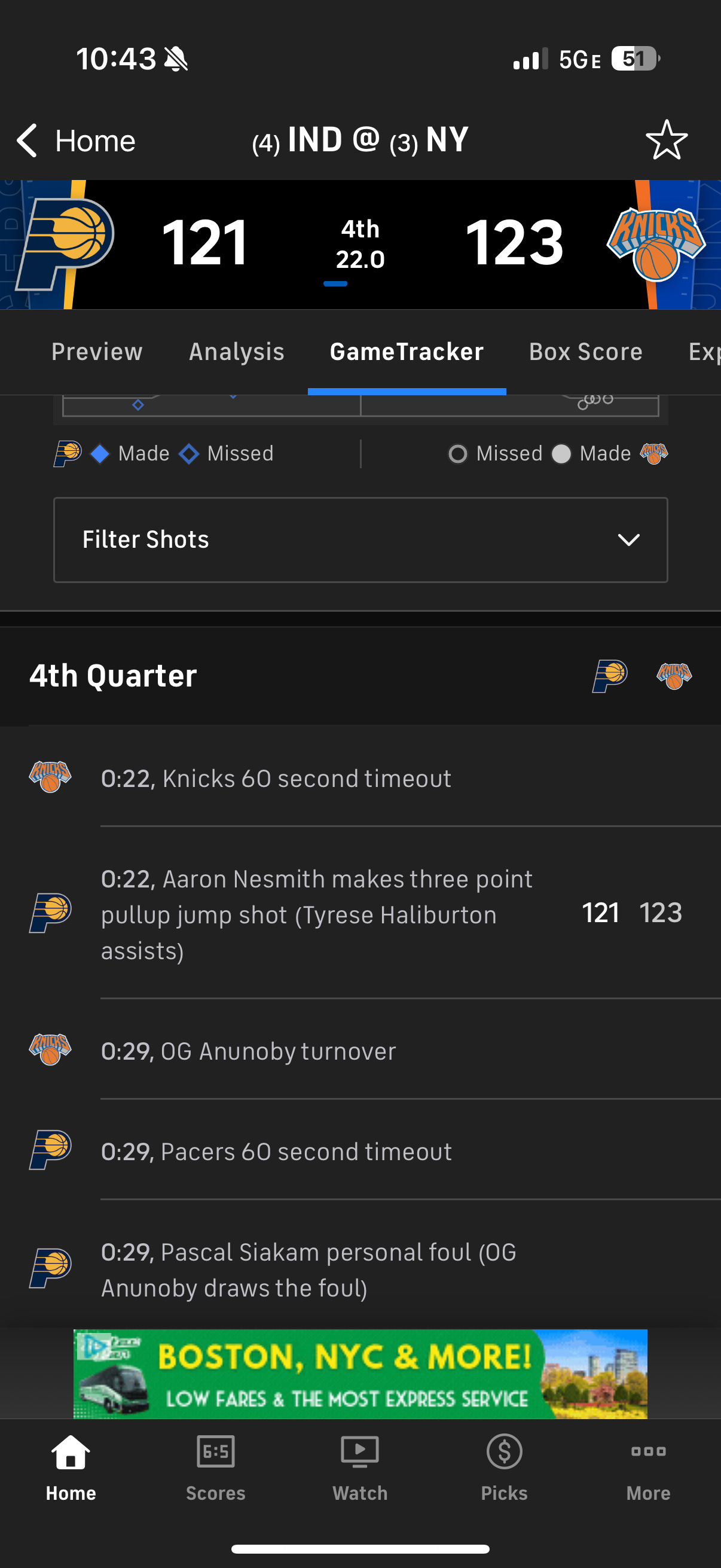

10:43pm: The game got closer and closer. I casually looked at my phone. “He’s going to make a 3,” and sure enough, the Pacers closed the Knicks lead to just 2 points.

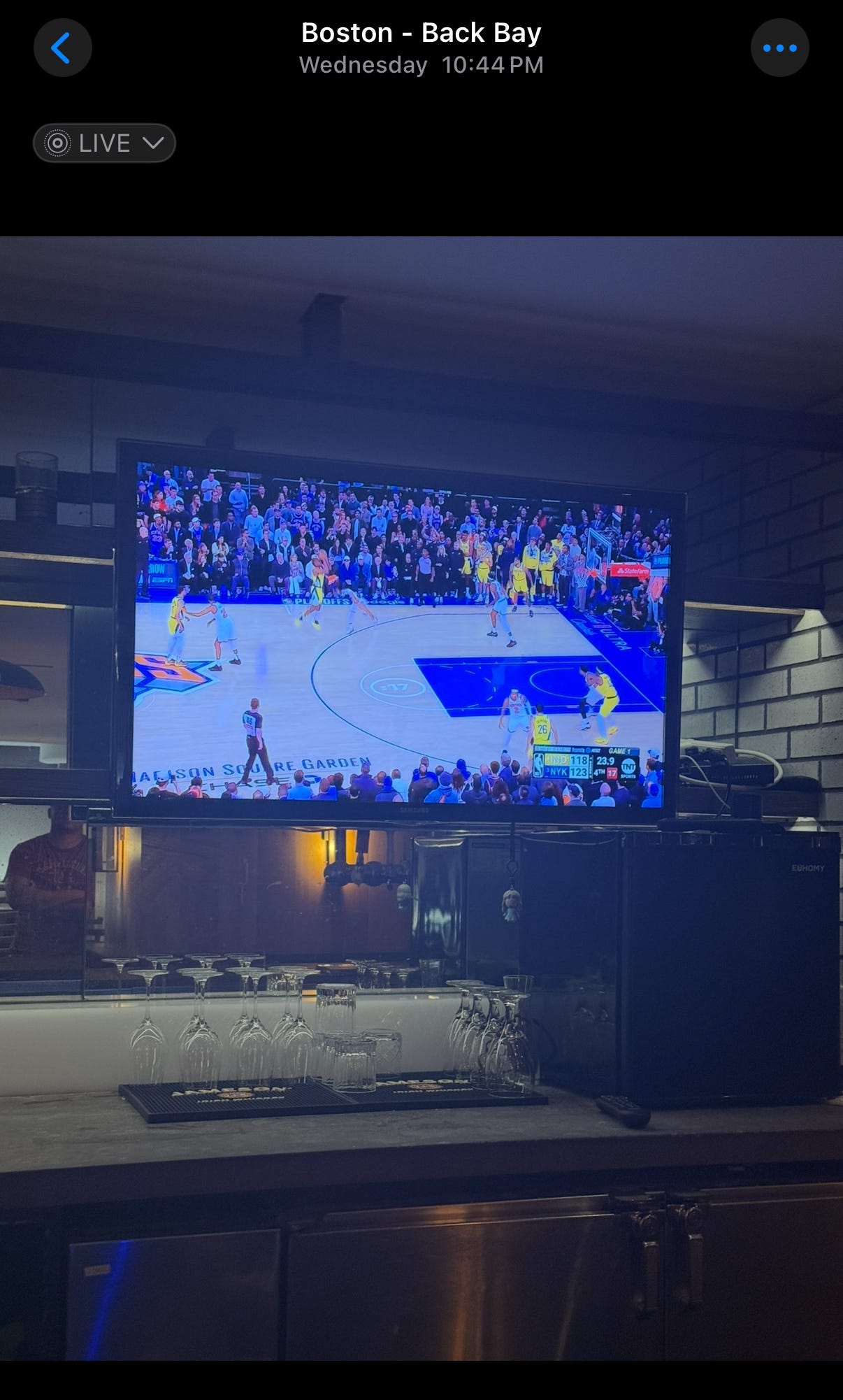

At 10:44 p.m., the Boston hotel bar got its confirmation.

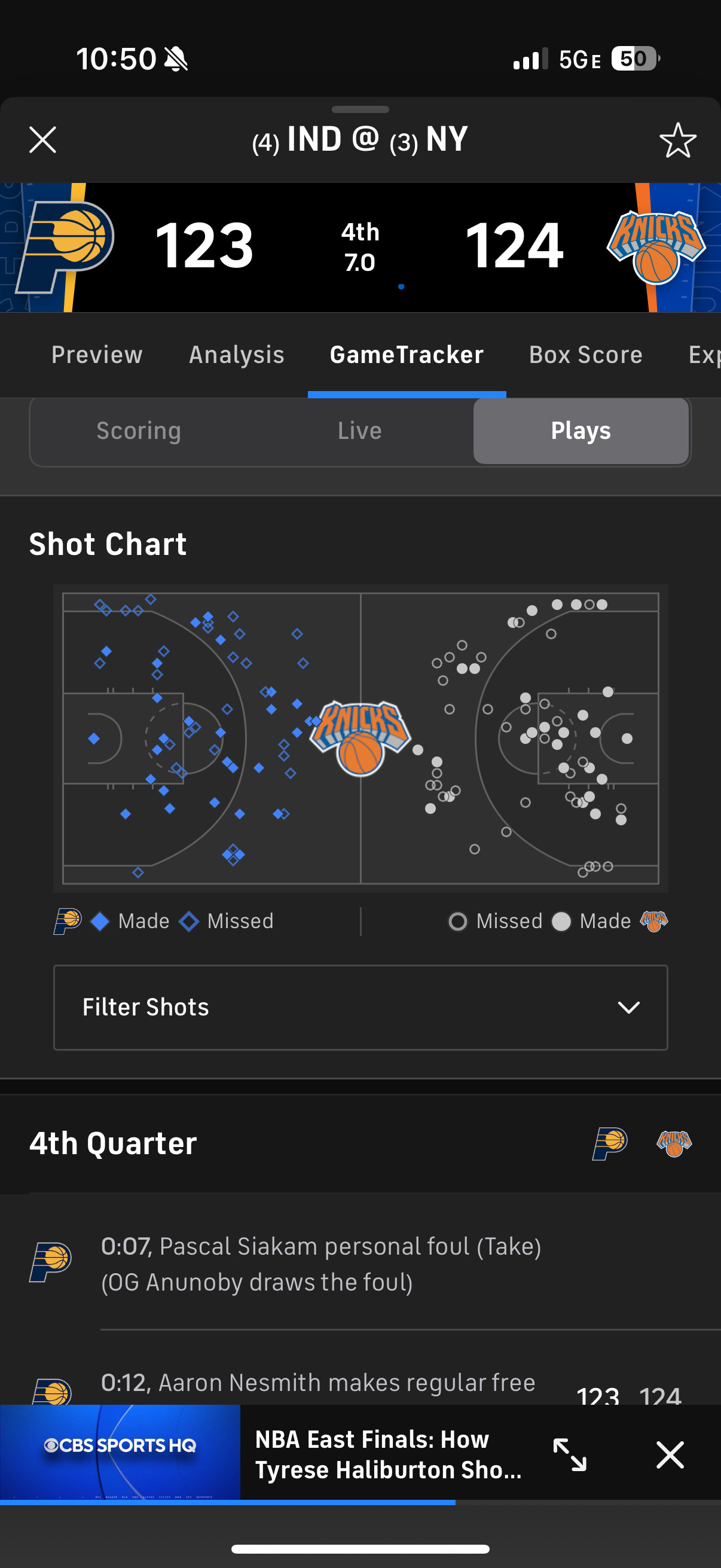

15 basketball game seconds later, but 6 real minutes later at 10:50pm, the game got even tighter. “The Knicks will get to the line here for free throws to try to extend the lead.”

So it’s down to the wire. “Knicks are going to miss the first free throw and make the second,” another person said. “No way, look at his face (he looked nervous); he’s going to miss both.” Of course, he made the second.

10:51pm: After the second made free throw with 7 seconds left in the game, it was 125-123 with the Knicks leading. The Pacers had the ball, with a chance to hit a three-pointer for the win or a two to send the game to overtime with a tied score.

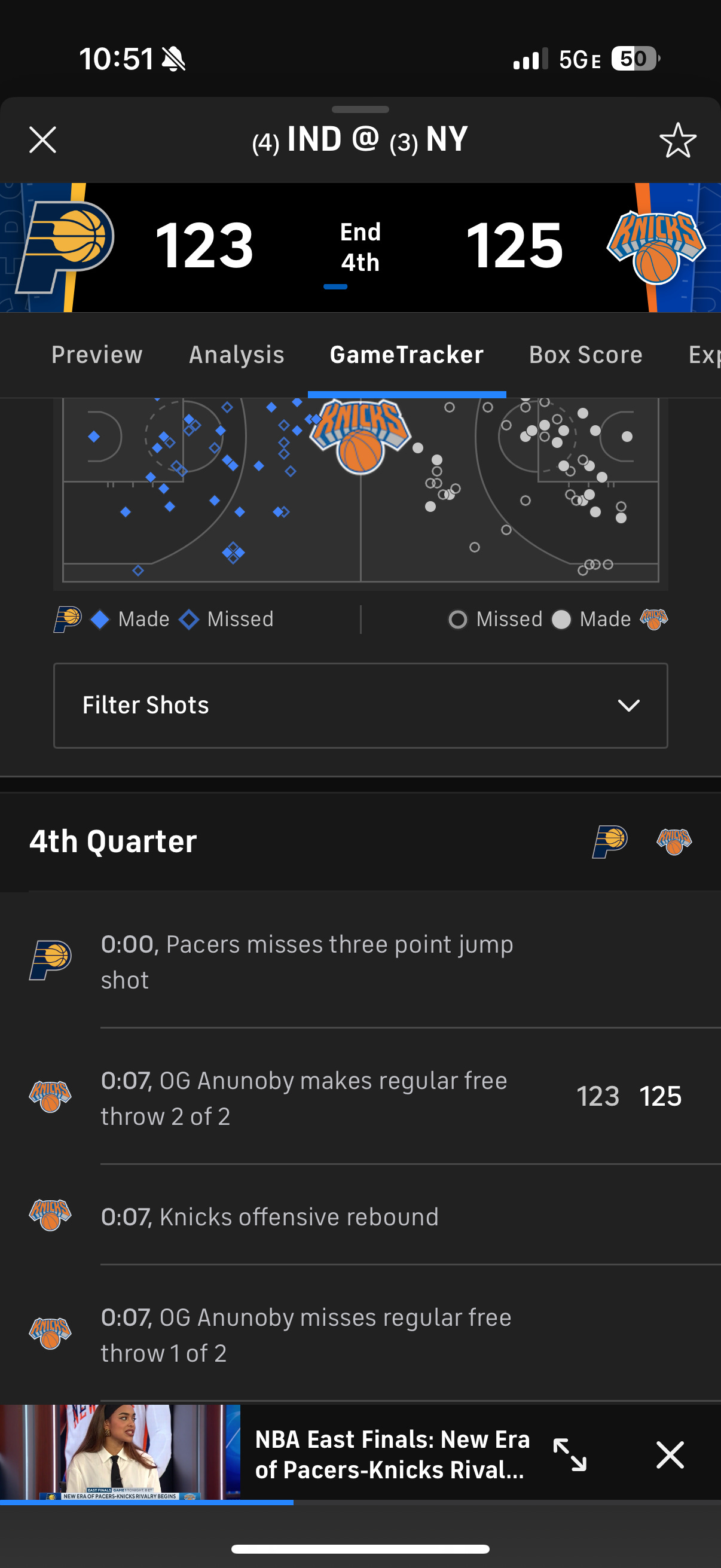

I glanced at my phone to “see the future.” The ball was inbounded and this is what I saw on my phone …

“Pacers 123. End of 4th. Knicks 125.” Below the shot chart, it says the time remaining is 0.00. It says, “Pacers misses three-point jump shot.”

“The Knicks are going to win!” I proclaim with confidence.

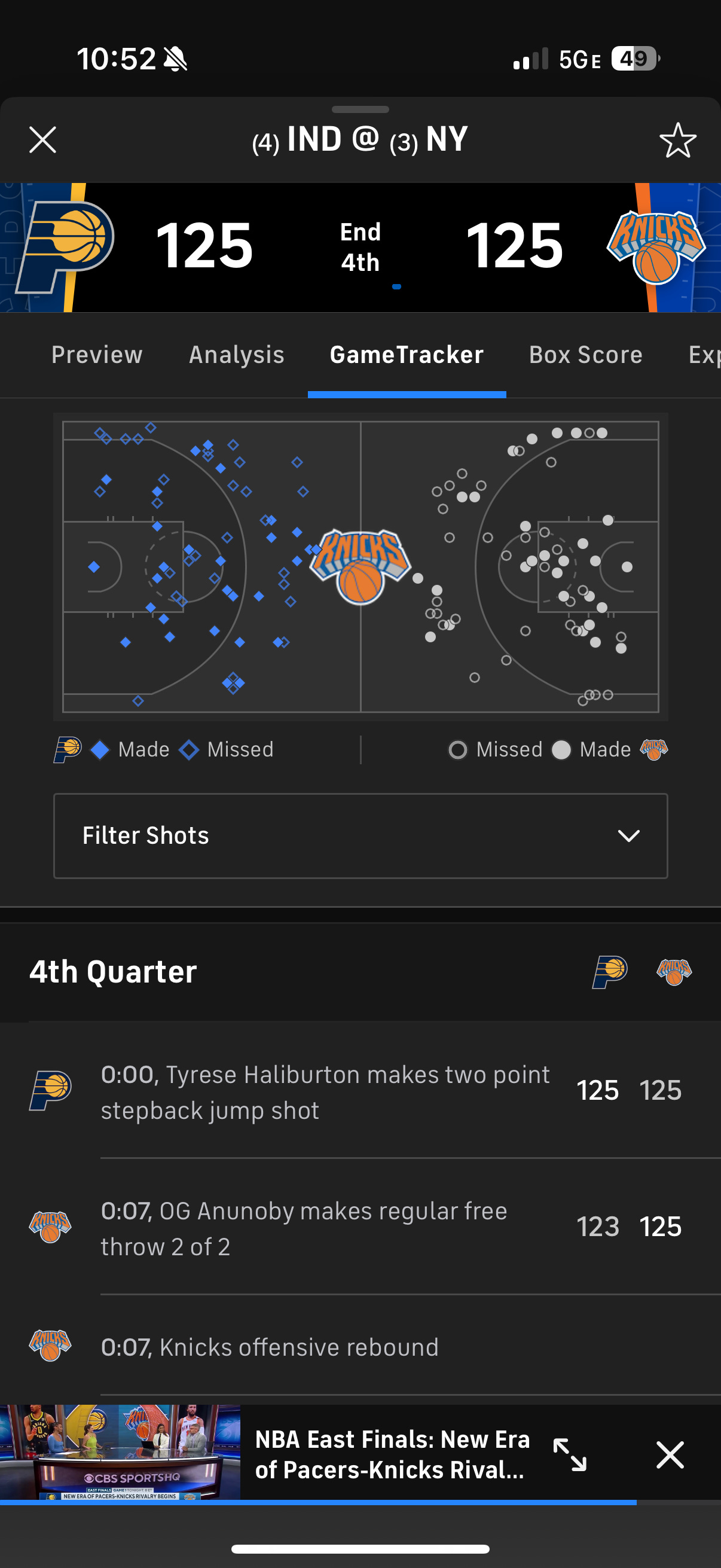

10:52pm in the bar. I wish I took a video of the bar while making the definitive claim and seeing the reaction of the bar. For the article we will need to imagine it happening while watching the highlight of the final play. This is what happened next:

The bar erupted!

“Wait… What… just happened …”

The bartender laughed and said, “You knew this would happen.”

I can’t imagine the bewildered look he must have seen on my face. I thought the Knicks won. The app told me they won. But no, the reality was a tied score. That couldn’t be right.

The app said the game was over, with the Knicks winning. Did I read the app wrong?

I looked back at the app while the refs reviewed the play to decide if it was a 3- or 2-pointer. A foot on the line meant it was a 2-point shot and tied game going into OT.

The app had quietly revised the result, now showing a tied game instead of a Knicks win.

That’s when I realized this wasn’t about latency at all. This article was about trust.

Not only did the app with the robots and/or humans behind the app make an error, but it was at the most pivotal moment of the game!

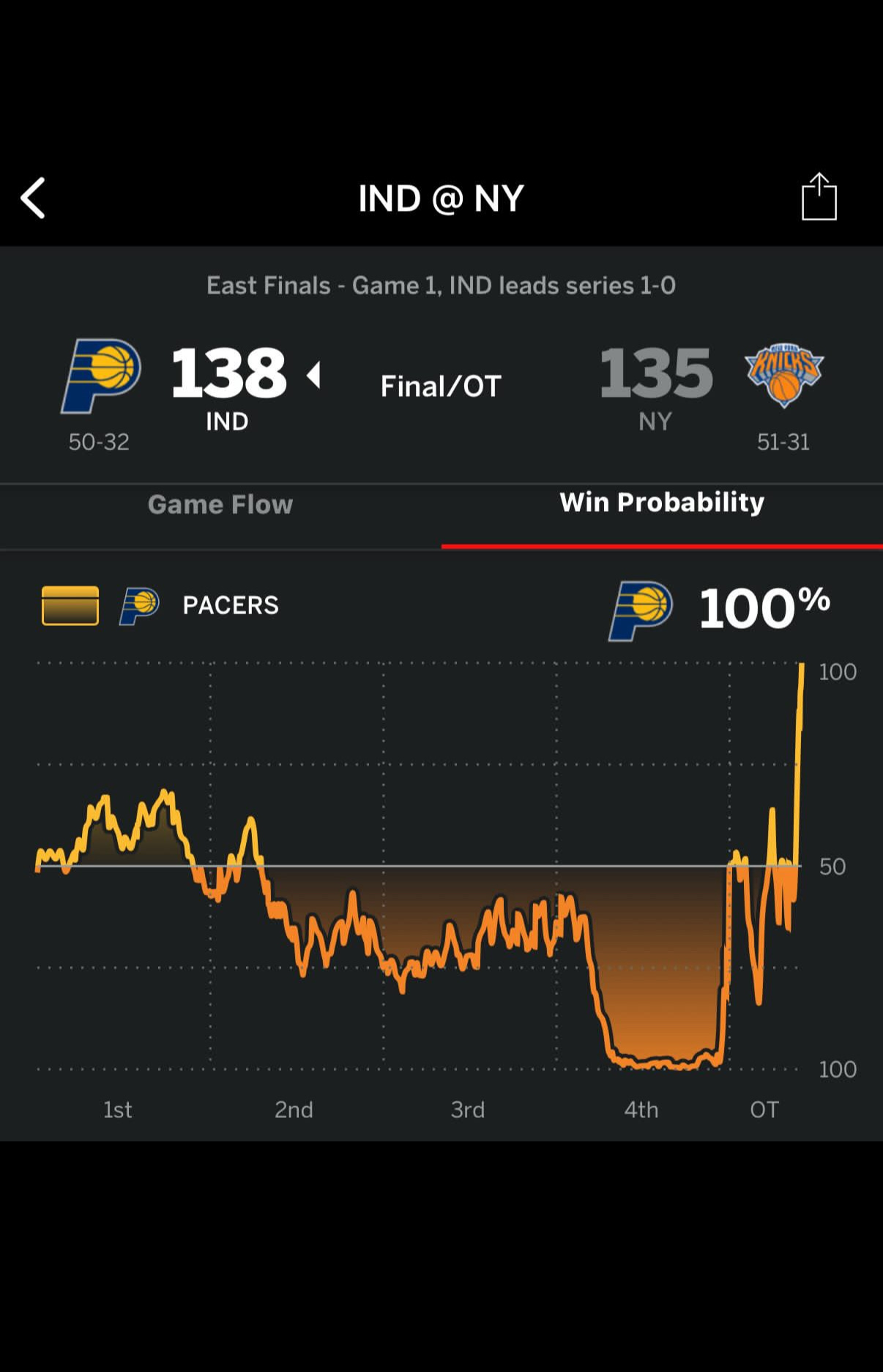

The Knicks would go on to lose the game in overtime, confirming a nearly sure win for the Knicks turned into a loss.

Such is the life of a Knicks fan, which is perfectly summed up by the soul-crushing Knicks moment in Pixar’s Soul.

It turns out being misled by a signal at the worst possible time isn’t just a Knicks fan experience. It’s a Wall Street one too.

This isn’t limited to sports; it happens in markets too.

Just six weeks earlier, something much bigger—and more expensive—played out in a similar way.

On April 7, 2025, an X account known as Walter Bloomberg (a popular but unofficial news aggregator) posted that President Trump was considering a 90-day pause on tariffs for all countries except China.

The market loved it.

In just 10 minutes, the S&P 500 added $2.4 trillion in value. Traders, quants, and bots across the globe reacted to what looked like a golden early insight. Confidence surged. Risk-off flipped to risk-on in a heartbeat.

And then… the White House denied it.

My reaction to the buzzer-beater was probably just a fraction of what “Walter Bloomberg” felt when the market reversed.

To be fair to the Walter Bloomberg account, the news of the 90-day pause started on CNBC and was later confirmed not true. (Real) Bloomberg posted the headline. And that’s how the unofficial aggregator came across the news.

The source was wrong (for the day at least). And the market instantly reversed—shedding $2.5 trillion in 23 minutes. A headline, a tweet, a burst of optimism—all gone.

Eventually, the news proved accurate, but for reasons no one predicted.

Days later, the Trump administration did announce the 90-day pause, after the bond markets began to trade off. The reversal of direction sent share prices higher like the initial incorrect headline indicated (a chaos trial balloon of some sorts that showed a lever to pull?).

It’s often joked that everyone is right in the long term, which is really code for being wrong before eventually being right for different reasons than initially stated. Had the bond markets not reacted on the 9th of April, would the real 90-day tariff have happened?

For the most nimble of the institutional asset managers, they could react quickly enough to news to get in and out on the signals. The slightly lagged missed opportunities or got caught on the wrong side of trades.

Lessons for data-driven investing

So what can we take away from a Boston bar and a $2.5 trillion fake-out? That in the world of early signals, certainty is often the illusion. And calibration is the edge.

This was supposed to be an article about latency from an unexpected experiment caused by a lagged TV feed and the power of having an early read on the market. It was meant to show how even a two-minute edge in information, on the court or in the market, can shape behavior, perception, and opportunity.

But The early signal was wrong. At the pivotal moment, the app told me the Knicks won. But it was wrong and suddenly this article wasn’t about latency—it was about data quality and trust of signals.

Whether in a Boston bar or on Wall Street, both stories show how the illusion of early certainty can collapse when the data isn’t right.

Just like the case of the Walter Bloomberg X account:

The signal arrived early.

It carried the weight of authority.

It was trusted.

And it failed when it mattered most.

And in both cases, those who trusted without verifying experienced not just confusion, but consequences.

Speed and accuracy

This wasn’t just a Knicks loss. It was a reminder: confidence in an unverified signal is just a prelude to disappointment.

Early data is intoxicating. In investing, being first can mean alpha. In sports, it makes you look like a prophet. But if the source lacks transparency, integrity, or the ability to admit and correct errors visibly and accountably?

Then you’re just betting on fiction.

Markets reward not just speed, but verified insight. Being fast and wrong costs more than being slow and right.

Navigating early signals in alternative data

As data providers find their product market fit with predictive data, the demand grows for more frequent refreshes with less lag versus real time. This introduces potential for early indicators. In alternative data, early isn’t always right. A Bayesian approach with updating baselines and calibration of investments based on new info makes it possible to get the best of both worlds compared to taking one big bet on the earliest “can’t lose” insight. Calibrating for confidence, not just speed, is what separates signal from noise.

— Jason DeRise, CFA

If you invest for the long term, getting some data early won't matter anyway...