Can AI Match Sell-Side Analysts? Testing OpenAI’s Deep Research

I put OpenAI’s Deep Research to the test—can it produce institutional-grade sell-side reports, or is it just repackaging consensus? Here’s what I found.

Can AI match the human sell-side1 analysts output? I tested OpenAI’s Deep Research to find out. The result? AI can replicate "average" sell-side reports but lacks proprietary insights, making it more of a tool than a replacement. This experiment highlights AI’s strengths, its surprising mistakes, and what it means for the future of investment research.

Key Takeaways from This Experiment

Before diving into this in-depth exploration of OpenAI’s Deep Research, here are the most surprising insights from this thought experiment:

AI Can Replicate Average Sell-Side Research, But Not Top Analysts – OpenAI’s Deep Research generates well-structured institutional reports that match the quality of “average” sell-side research, but it lacks original insights and non-consensus thinking. AI can replicate it mainly by summarizing past data and consensus2 views.

Speed vs. Substance Tradeoff – AI produced a 10,000-word investment report in just 7 minutes—far faster than any human—but some critical errors in valuation and outdated data show the necessity of human-in-the-loop oversight.

Sell-Side Research’s Business Model May Shift – AI’s ability to generate “desk research” efficiently could challenge firms that lack platform advantages or star analysts, while enhancing firms that integrate AI effectively. The article discusses my take on this with suggestions for practical applications.

The Real Value Lies in Collaboration, Not Replacement – The most significant opportunity for sell-side analysts isn’t fighting AI but learning how to leverage it to automate routine tasks and focus on deep, differentiated analysis. The machines can unlock potential that we are currently held back due to the huge time it takes to do even “average” sell-side research. I thought back to my own experience as a sell-side analyst, working deep into the night to create research worthy of a top ranking. I wonder what I could have achieved if I had more time for next level analytics and how a tool like this could have made it possible.

AI’s Decision-Making Feels Strangely Human – The AI even “changed its mind” mid-experiment, adjusting a stock rating based on restructured prompts—demonstrating how prompt refinement impacts AI reasoning.

AI Won’t Replace Analysts, But It Can Reshape Sell-Side Research

AI is a powerful tool that can automate time-consuming research tasks, but it does not generate original, non-consensus insights—the hallmark of top-ranked sell-side analysts. What this means for the industry:

For top analysts: AI can free up time for deeper research but won’t replace the best minds.

For the sell-side model: Sell-side firms that focus on their platform strength and/or their star analyst power have the potential to leverage AI to expand their competitive advantage. For firms creating "average" research, AI could disrupt consensus-driven analysis. The value proposition should shift toward original insights and proprietary data, not just information gathering, which can be handled by AI.

For knowledge workers in general: AI isn’t a threat—unless you ignore it. Learning to integrate AI into research will be a key competitive advantage.

These findings shape the broader question: Is AI a collaborator or competitor to sell-side analysts? Read on for the full experiment, evaluation, and industry implications.

The very long-form article includes the following sections:

The Catalyst for the Experiment

How the experiment is run

Assessment of the first version of the AI generated report, including the unedited text created by OpenAI Deep Research

A second attempt to improve the report, with a big issue

The third final attempt with commentary, and the unedited text created by Open AI Deep Research

Implications for the industry

***Disclaimer: The report generated by OpenAI Deep Research is definitely NOT investment research and should NOT be relied on for any investment decisions. This is a thought experiment to see how OpenAI’s Deep Research would stack up compared to real sell-side investment research.***

Welcome to the Data Score newsletter, composed by DataChorus LLC. The newsletter is your go-to source for insights into the world of data-driven decision-making. Whether you're an insight seeker, a unique data company, a software-as-a-service provider, or an investor, this newsletter is for you. I'm Jason DeRise, a seasoned expert in the field of data-driven insights. I was at the forefront of pioneering new ways to generate actionable insights from alternative data. Before that, I successfully built a sell-side equity research franchise based on proprietary data and non-consensus insights. I’ve remained active in the intersection of data, technology, and financial insights. Through my extensive experience as a purchaser and creator of data, I have gained a unique perspective, which I am sharing through the newsletter.

The Data Score introduced premium content on February 1st, which is behind a paywall. Data Playbook, Data-Driven Investing, and Dataset Deep Dives will be premium content. These sections provide actionable strategies, in-depth case studies, and exclusive expertise tailored for data-driven professionals. The subscription for premium content is priced at $9.99 per month or $99.99 annually.

This content is free and featured in our AI Integration section. The content is meant to explore possibilities with case studies, is open for feedback and hopefully encourages more experimentation.

The catalyst: Open AI’s Deep Research Demo

In OpenAI’s words, it’s Deep Research Product is “an agent that uses reasoning to synthesize large amounts of online information and complete multi-step research tasks for you. Available to Pro users today, Plus and Team next.” Link to product launch announcement

Open AI on how it works “Deep research was trained using end-to-end reinforcement learning on hard browsing and reasoning tasks across a range of domains. Through that training, it learned to plan and execute a multi-step trajectory to find the data it needs, backtracking and reacting to real-time information where necessary. The model is also able to browse over user uploaded files, plot and iterate on graphs using the python tool, embed both generated graphs and images from websites in its responses, and cite specific sentences or passages from its sources. As a result of this training, it reaches new highs on a number of public evaluations focused on real-world problems.”

Deep Research has limitations. In OpenAI’s own words: “Deep research unlocks significant new capabilities, but it’s still early and has limitations. It can sometimes hallucinate facts in responses or make incorrect inferences, though at a notably lower rate than existing ChatGPT models, according to internal evaluations. It may struggle with distinguishing authoritative information from rumors, and currently shows weakness in confidence calibration, often failing to convey uncertainty accurately. At launch, there may be minor formatting errors in reports and citations, and tasks may take longer to kick off. We expect all these issues to quickly improve with more usage and time.”

For years, predictions of the sell-side’s demise have proven exaggerated. Could AI be the real disruptor?

After watching OpenAI’s Deep Research demo, my initial reaction was that it could replicate what at least half of sell-side analysts do: summarize facts and align with consensus opinions, rather than add new insights.

However, not all sell-side research lacks value. When I covered Walmart, one of the largest companies in the world by market cap at the time I covered it, there were ~40 other publishing sell-side analysts who covered the company. There were 20–25% who wrote thoughtful, non-consensus research on the company that advanced the market’s thinking and helped institutional investors make better decisions. The rest seemingly just went through the motions of the quarterly earnings cycle, updating estimates that were very close to consensus and reiterated the known positives and negatives that the company has talked about in public forums. Producing this type of research does still require significant effort from analysts and their teams to gather, organize, and analyze data. However, research that aligns too closely with consensus does little to advance key market debates or enhance institutional decision-making. This kind of sell-side research makes up the vast majority of the consensus estimates. Analysts with a neutral view typically have estimates in line with the consensus and describe the current positive and negative facts as offsetting. The “average” bullish sell-side analyst tends to choose a forecast that is purposefully slightly above consensus, emphasizing positives while claoming risks are already reflected in the stock’s price.

To evaluate Deep Research firsthand, I upgraded to ChatGPT Pro for $200 and tested its capabilities for this Data Score Newsletter experiment. Can OpenAI’s Deep Research meet the standard of an “average” sell-side research report?

Understanding the Sell-Side Business Model

AI’s ability to compete with sell-side analysts raises fresh concerns about the industry’s future viability. Yet, demand remains strong for high-quality, proprietary insights from top-tier sell-side analysts. There is also a lot of not-so-valuable sell-side research available, in my opinion. It’s important to understand the business of the sell-side to understand why there could be a wide range of quality across the sell-side. It’s also important to note that even “average” sell-side research is hard to do.

First, let’s clarify the role of a sell-side analyst and the factors that distinguish top performers. Let’s also talk about the economics behind the competition of sell-side analysts: It’s important to understand how sell-side research firms compete and generate revenue. We need to talk about soft dollar commissions, MIFID (Markets in Financial Instruments Directive), broker votes, and rankings from institutional Investor/Extel surveys.

Sell-side research analyst role: The sell-side analyst published research on their coverage, which is typically a sector and geography, which would include anywhere from 5 to 20 names depending on the sell-side research department’s business model. While they are not actually investing money, they are writing research for institutional investors (and sometimes repurposed for retail investors) to help them make better investment decisions.

How sell-side equity research generates revenue and profit: Research is a service that is paid for by the buy-side. There are two primary mechanisms for payment.

Soft dollar commissions—In the US, to avoid conflicts of interest at broker dealers, research is not allowed to be directly paid far. Instead, the research is a service added to the trade execution and other services provided. To compensate the firm for research, soft dollar commissions are used such that if the client values the research, they will execute more trades with the firm.

MIFID/subscription-based: In Europe, the view is that research should be paid for separately from execution and that the institutional investors have a fiduciary duty to pay for the best execution of their trades separately from the research costs. The goal is to increase the transparency of costs to the end clients of the mutual funds, hedge funds, and pensions (i.e., retail investors). Independent research firms, unaffiliated with broker-dealers, operate on a subscription-based revenue model.

Sell-side rankings via Institutional Investor/Extel: There are 3rd party surveys of the quality of the analysts in each sector, voted on by the buyside. This creates the rankings. Regardless of the payment model, the top three ranked analysts in each sector dominate market share and drive the firm's profitability.

The implication is that there is a decay curve in profitability where the top-rated analysts generate the vast majority of the revenue and profitability amongst the competing analysts. It’s also a self-fulfilling paradigm, where the buy-side investors need to talk with the top-rated analysts and read their research because they are influencing their buy-side competitors. Also, buy-side investors who are new to a sector or company and need to get ramped up quickly in their knowledge typically choose to call the top-rated analysts to get advice.

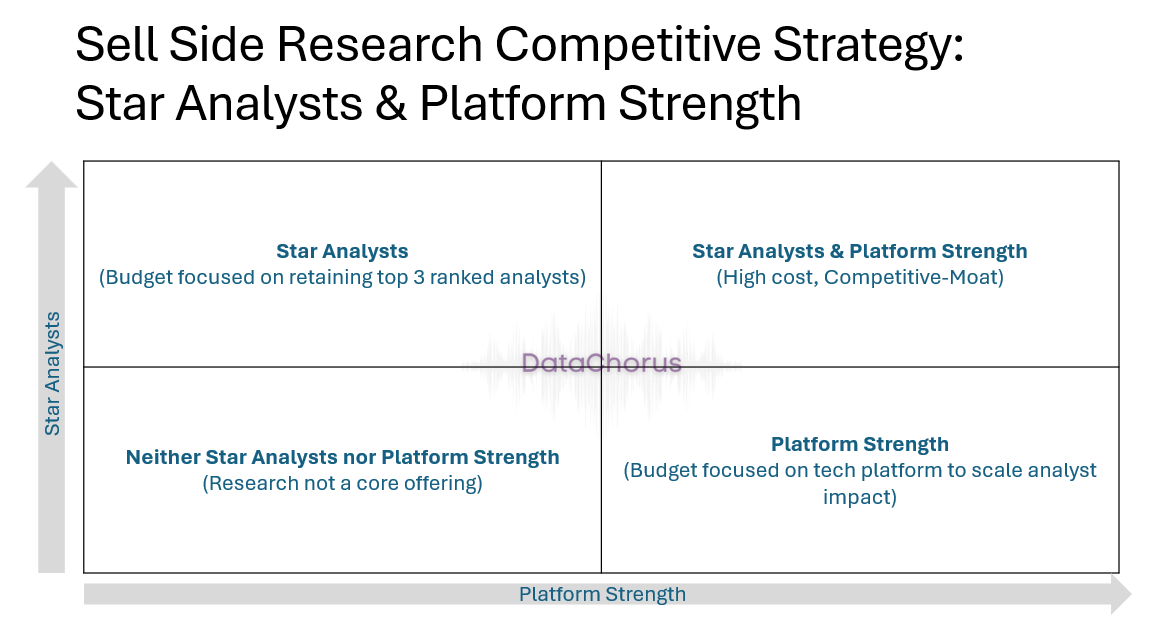

To understand how AI might reshape sell-side research, we need to first examine what makes a research firm successful. The competitive landscape follows a simple 2x2 framework. The dynamic is across the dimensions of platform strength and star analyst strength.

Both Star Analysts and Platform: These are firms that have the breadth and depth of coverage, powered by platforms that allow their analysts to focus on their differentiated value-added work. These firms are also willing to pay for star analysts who can command materially higher compensation than the average analyst. This approach creates a moat because the investments are hard to replicate by others but only work if they maintain their high market share.

Platform Strength, Only: This approach focuses on establishing a platform that allows up-and-coming analysts to rapidly accelerate their impact on the market through technology-driven decisions. Not only does technology help provide analytic insights and proprietary data points, but the platform also helps make it easier to run the business, optimize the analyst’s client-facing time, and focus efforts on high ROI activities. It also provides firm protection if analysts depart for their next opportunity; the proprietary information is institutionalized and available for the next analyst in the seat. The focus on the investments is on the technology platform more so than paying for star analysts.

Star Analyst Strength, Only: This approach focuses on paying for analysts that are top 3 ranked in each sector that the firm competes in. These top ranked analysts command the majority of the market share of the sector’s research dollars. Firms have to pay highly for the analysts because they can be bid away by competitors who are also following a star analyst strategy. These firms prioritize human capital investments over technology. That’s not to say there is no investing in technology (just like in the platform strength only category, they do invest in human capital); it’s just that they choose to differentiate themselves versus competition based on the human capital investments. The risk is that when star analysts leave or retire, their institutional knowledge isn’t easily transferable, forcing successors to rebuild coverage from scratch. Star analyst churn can lead to extended periods of under-coverage of sectors. Also, due to the limited platform investments, it’s harder for star analysts to cover many companies well, so coverage tends to be limited.

Neither Platform nor Star Analyst Strength: It would be hard to find a research firm that would admit this. However, there are sell-side research firms that have limited platform investments and do not pay to retain the top 3 analysts. The analysts at these platforms are self-made success stories and are likely poached by other platforms who would either pay for the analyst potential as a star analyst or the analyst is attracted to the opportunity because the platform enables their future success. These firms aren’t actually competing to win in research. Because institutional-grade research, even if it’s average quality, is still very hard to do, it’s a valuable add-on service to the business’s other services.

The majority of individual sell-side research analysts in part because of their firms’ business model fall into the “lower left” box because research is not the service they are primarily competing on. It could be that it’s an additional service for retail/wealth advisory clients. It could be that by providing research, it enables other services like corporate access3 and provides visibility for the firm's overall marketing. Maybe there’s other reasons. I’ve only worked at sell-side firms that valued star analysts and/or built a platform that enabled young, high-potential analysts to thrive. The point is, it shouldn’t be a surprise that there is a lot of consensus-hugging, non-special published research. And there is definitely a consumer for that type of research.

Even producing “average” sell-side research is no small task

The people doing the work have to put in massive hours to gather facts, build financial models, write research reports, and verify accuracy. They leverage years as an associate, where they learn the craft as an apprentice. They build on academic study, many at prestigious universities. Even the average sell-side analyst is well paid compared to other professions. It’s no small task to be able to generate average sell-side research from AI.

An analogy: In professional sports, even the average player is highly skilled, yet they fall far short of the star performers. The same applies to sell-side analysts. The equivalent example would be if we built a robot that could do the job of an average player in a professional sport. That would be an exceptional milestone in the advancement of AI and robotics.

Is AI a Threat or a Tool for Sell-Side Analysts?

With the advancements in Generative AI’s ability to apply some reasoning logic with RAG pipelines4 that bring in relevant real-time information, it’s possible the “average” sell-side analyst has a new competitor. Or rather, it could be a new collaborator for star analysts or an enhancement to the platform-driven sell-side research.

The ability of AI even in its current state is not going to be the best AI we see in our lives. It’s important that everyone who is a knowledge worker begins to learn how to use AI collaboratively today. By far, that’s the most important thing to take away from this experiment. Can we shed the basic time-consuming nature of knowledge worker roles by collaborating with AI and reach new levels of creativity and insights?

The bullish view is that generative AI becomes an enabler of the sell-side to reduce the time it takes to do basic desk research and free the analysts to spend more time on the deeper analytics that advance the market’s understanding of the key investment debates. It can also be an enabler for the star analysts or become part of the platforms that are an enabler analyst’s success.

Let’s test out that machine’s ability to compete as an average “player on the field”.

Running the Experiment

I will share my prompts and the response of ChatGPT o3-mini Deep Research as I go through the test of the capabilities. I want to make sure I’m challenging the machine to do research that would be value-add, but I also don't want to focus on too many computational activities. That could be a different AI agent to build the model and run the valuation. Nevertheless, I do need to reference those concepts of modeling financials and valuation; otherwise, I can’t truly test if OpenAI’s Deep Research is a new competitor.

Research Challenge: European Beverages Sector with a focus on Diageo and Pernod Ricard

Why I Chose This Test

I chose a sector I previously covered as a sell-side analyst: European Beverages. I was a senior associate at Sanford Bernstein and then a senior sell-side analyst at UBS covering this sector between the years 2006 and 2011, with a brief reprise of the role in 2015. While I no longer cover it, I have stayed aware of the key debates and trends, making it an ideal test for me to assess if AI can match an “average” sell-side analyst.

The European Beverages sector is predominantly made up of beverage alcohol companies like Pernod Ricard, Diageo and Heineken. Diageo and Pernod Ricard, both global businesses with complex product lines, are covered by approximately 20 sell-side analysts. I chose this sector as a starting point because the ~20 analysts’ coverage would mean there is less analytical content available across the web available to OpenAI. Also, because these are European-listed companies, they may limit the available content. These global companies operate across multiple regions and manage diverse brand portfolios that drive overall results. The industry faces significant challenges today, creating both upside and downside scenarios for typical sell-side research. So, this is quite a complex task for Open AI’s Deep Research to meet the standard of “average” sell-side research.

Testing AI vs. the Sell-Side: Can OpenAI Match Average Analysts?

Prompt 1: You are a senior equity sell-side research analyst at an investment bank covering the European beverage sector and need to initiate coverage of Diageo and Pernod Ricard. Create a research report that covers the relevant industry dynamics that are headwinds and tailwinds, company-specific challenges and opportunities, determine the likely revenue and profit growth of each company over the next 5 years, including an assessment if consensus estimates in the next 12 months are too high or too low. Generate a valuation of the companies and compare it to the current share price. Leverage company results, company commentary, alcohol industry trade magazines, general news, financial services data, and retail investor commentary to generate the research report. Assign a buy, neutral, or sell rating. The goal is to be right on the investment recommendation on a 12-month view. Structure the research report in a pyramid principle format. Include supporting data points with each stated opinion.

🤖ChatGPT o3-Mini Deep Research: To ensure a comprehensive research report on Diageo and Pernod Ricard, could you provide additional details on:

Geographic Focus: Should the analysis focus on European operations, global performance, or specific regions?

Valuation Metrics: Are there specific valuation models you prefer (DCF, EV/EBITDA5, P/E6 multiples, etc.)?

Peer Comparison: Should we compare these companies to a defined peer set, and if so, which peers should be included?

Macroeconomic Assumptions: Any particular macroeconomic scenarios to incorporate (e.g., interest rate trends, FX assumptions, inflation impact)?

Investor Profile: Should the report cater to institutional investors, retail investors, or a mixed audience?

Let me know these preferences so I can tailor the research accordingly.

Prompt 2: Great questions. 1. Geographic focus: They are global companies, so think about breaking down the analysis by North America, Europe, China and the rest of the world. Both companies have different geographic and product exposures. This should be considered in the analysis and research.

2. Let's think about P/E multiples, especially relative to their own history, relative to each other and relative to the overall beverage industry multiples.

3. Peer comparison should include Campari, Remy Cointreau, Heineken, AB-InBev, and Carlsberg.

4. Macro assumptions: consider the current macroeconomic trends continuing but then explore scenarios where the global and local economies deteriorate and a scenario where they improve from here.

5. The report should cater to institutional investors only. Do you have any other questions before you begin the research?

It didn’t ask any additional follow-up questions. It gave me this response:

🤖ChatGPT o3-Mini Deep Research: Understood. I will conduct an in-depth analysis of Diageo and Pernod Ricard, covering global industry dynamics, company-specific strengths and risks, revenue and profit forecasts, and valuation metrics. The analysis will break down by key geographic regions—North America, Europe, China, and Rest of World—considering the companies’ respective exposures.

I will assess whether consensus estimates for the next 12 months are too high or too low, conduct a valuation comparison using P/E multiples relative to history, peers, and the overall beverage sector, and include sensitivity analysis based on macroeconomic scenarios. The research will also incorporate a peer comparison with Campari, Remy Cointreau, Heineken, AB-InBev, and Carlsberg.

I will return with the full research report once the analysis is complete.

It began listing which sources it was reviewing. I began typing the introduction to this report, expecting it to take an hour. 7 minutes and 30 sources later, it had generated its full report.

My first reaction to Open AI’s Deep Research output

My first reaction? Wow! In 7 minutes, OpenAI produced a convincing 10,000-word institutional-grade research report—faster than I could draft the introduction to this article.

As I read through the report, I thought about the countless late nights, writing institutional-investor-grade research on these companies. The countless hours combing through the details of each company press release, notes from conversations with company management, and the various industry data new sources. I thought about those late nights when I would look over the balcony to the empty trading floor, which was empty, knowing I had to have valuable insights and data points to back up the views I was about to publish in the morning to our clients. And I knew that both our sales force and our clients would judge if I had actually added value through my report. The countless cups of coffee and the Metallica songs blasting in my headphones to keep me motivated to keep digging in deep to keep pushing for the best possible research report I could write. I thought about the competitors, mostly the ones who were top of the Institutional Investor and Extel rankings, but also the average analysts. Would the report I was working on be seen as top-tier or average? I needed to dig in deeper, put more hours in—my research had to add the most value.

What deeper insights and better analysis could I have generated if I had more time for value-added work instead of spending many hours each day gathering data and organizing it in a written report?

I think I know what Rick Rubin was talking about when he said he cried when he learned that AI had beat the master champion Go player with a “creative” move that no human ever would have done. Legendary music producer Rick Rubin said he felt motivated that AI could help unlock more potential in humans because it doesn’t have the “expert” baggage we bring to creativity and brings none of the social norms to the creative problem solving. He shared this story in his book “The Creative Act” and discussed it on a few podcasts; here’s one example.

Rubin: And the announcers who were the expert announcers were like, “Oh, the computer, it screwed up. It doesn’t know what it’s doing. It can’t be that, that’s a wrong move.” And then eventually the Grandmaster comes back, they finish the game, and the computer wins the game. And I hear this story and I realize that I’m crying. And I don’t understand what’s going on. I don’t know, why am I crying? Am I crying — The surface answer would be, “Oh, the machine has conquered man and we’re all in trouble.” It’s doomsday, right? That would be one…

Tippett: Right. No, I want to say, I was going to ask you about this cause it was a stunning thing to read.

Rubin: Yes. But I didn’t have that feeling at all. That’s not what it was. So I’m crying. It’s like, well I don’t care if the machine wins or man wins. Why am I having an emotional reaction? What’s going on? And I thought about it for, I think I realized what it was on the same day, but it was hours later. I was thinking about it for hours. Where is the emotion in this for me? Where’s the emotion? And eventually, it clicked.

It was about creativity, which I take very personally and emotionally. So that’s why. I was crying because it was about creativity. And that the computer made a creative choice that man wouldn’t have made. And the reason the computer made the creative choice was not because the computer was smarter. It was actually because the computer knew less. The men playing knew — not only did they know the rules of the game, but they also knew the traditions of the game. And they knew the whole history of the game, of what every great player had done before. And they knew what they learned in the school of playing. The computer was only playing by the rules of the game because it doesn’t know the cultural norms of the game. So the fact that man’s own baggage of beliefs of thinking we know best is what was holding man back.

Tippet:Yeah.

Rubin: And the computer was what showed us that. And I thought it was so beautiful because that gave me hope for everything. That means there’s so much that we think we know that we don’t know. And maybe the computers can help us remove the distracting information that we hold true that’s stopping us.

The ability of AI even in its current state is not going to be the best AI we see in our lives. While this version of OpenAI’s Deep Research isn’t going to beat a top ranked analyst today, it’s possible it can in the future. The AlphaGo moment for the average sell-side analyst may have already happened.

It’s important that everyone who is a knowledge worker begins to learn how to use AI collaboratively today. By far, that’s the most important thing to take away from this experiment. Can we shed the basic time-consuming nature of knowledge worker roles by collaborating with AI and reach new levels of creativity and insights? Or if we choose to ignore its potential, it will displace the knowledge workers like sell-side analysts who do not choose to embrace it as a thought partner.

How I am going to assess the AI-generated research report:

I am going to consider 3 key qualitative questions in my assessment:

Is it accurately sourcing information?

Would I have published something like this?

Have I seen research reports published at this quality level, indicative of an average sell-side report?

Is it accurately sourcing information?

As I read through each data point in the AI-generated report and saw the references embedded in the content, I began thinking, for this article, do I need to sanity check every single one of these data point references as supporting proof for the claims made by OpenAI’s Deep Research output? If it were my own research, I absolutely would double-check every single figure. The goal of this report is to show it as is so everyone reading it can weigh in. I’m not editing the output from OpenAI.

The AI relied on a wide range of sources to compile its report based on what it had free access to. A sell-side analyst would have access to various services that require logins and subscriptions to access, which OpenAI should not have access to. So it had to be creative in it’s sources used. In the appendix of the report, you can read the Deep Research running commentary, which was generated in real time during 7 minutes of processing before the report was delivered. OpenAI Deep Reesearch relied on a mix of reputable and unusual sources. It cited industry leaders like IWSR and NielsenIQ—but also an unexpected local news station, “WTVB | 1590 AM · 95.5 FM | The Voice of Branch County.” Clicking through, I found it was simply aggregating Thomson Reuters news, restoring some confidence. Still, this highlights AI’s occasional struggle to distinguish authoritative sources from secondary aggregators.

A Flaw: The AI Used Outdated Data; the AI relied on outdated data points to justify its conclusions. I’ve noticed it is heavily relying on older data points to justify its claims. I’m seeing 2023 fiscal year references for data points, which for Diageo and Pernod is a June fiscal year end (not December). I’m not sure if the machine knows these are 18-month-old data points. In the real world, the financial markets will surely have digested this old info and would care more about recent data points. While the numbers sound right to me about geographic exposures and growth rates, if I were going to publish a report, I would have actually spent the vast majority of the time going over and over the numbers, making sure they were 100% right. There isn’t room for small errors when convincing institutional investors how they should change their portfolios. This is a major shortcoming—potential reliance on outdated data undermines its investment thesis.

I need to re-prompt it to put the most weight on the data points of the prior 6 to 12 months to better reflect the way the market digests information. This is an important learning: in the absence of a clear prompt about the relevance of historical data points, it will fill in its own logic.

A major missing topic in the research: the risk of tariffs. The AI-generated report seems to have missed the risk of tariffs on the Tequila business in the US for both companies. I need to prompt it to include some thoughts on this in the risk section in a second prompt while I’m clarifying the relevance of historical data points.

The valuation and consensus comparison appear realistic in both style and argumentation. But is the valuation accurate, and does it correctly interpret consensus estimates? Is its target price and relevant multiples to get to the target correctly done? The AI seems to have written up a valuation methodology that makes sense in the words it chose. It’s actually quite impressive that it captured the typical valuation write-up. If anything, it’s more detailed than some of the valuation sections in sell-side research. I’ve seen examples where analysts just say what multiple they apply to their earnings and have no written justification for the multiple selection. Based on the sources it found online, it seems like it’s using reasonable numbers for the P/E multiples and the earnings. This is better than I would have expected it to do.

It’s important to note that there’s not an actual financial model behind these figures. Rather, it’s just reasoning to the conclusion. While some analysts are known for building models and following the data to tell them the recommendation, there are plenty of analysts who start with their outlook view and then work backwards to the model and valuation inputs that generate a target price that works for their rating. I definitely do not recommend that approach, but if we are comparing with the average sell-side analyst, this isn’t too far from what happens.

Conclusion: With a second prompt, it is possible this can meet an average institutional investment grade quality research, but on a single-shot prompt it falls short (feels like user error, not limitations of Deep Research).

I will re-run the report with clearer instructions prioritizing recent data over outdated figures. That prompt should improve the value of the data points referenced in its investment arguments supporting the conclusions it generated.

Even if the data were perfect, would I publish this as my own research? No.

It lacks the depth needed for top-tier sell-side rankings. There’s nothing proprietary about the insights. There’s no analytical reasoning that looks for underlying clues that trends are turning for better or worse by digging deeper into data or applying analogous scenarios.

Is this something I could see meeting the standard of average sell-side research? Yes.

The vast majority of the AI write-up is backward looking for facts and then creating subjective opinions about how things will turn around for the two companies. The AI’s opinions about future industry and company fundamentals trends are explained logically. The valuation and comparison to consensus are logical in nature.

This reflects the work of average sell-side analysts, who often summarize past data and align with consensus ratings rather than adding fresh insights. In any coverage sector, there is a lot of consensus-hugging, where sell-side analysts avoid controversial opinions and keep their stock ratings and forecasts close to consensus estimates, often to maintain relationships with corporate management or avoid reputational risk.

This could pass for one of the 20 analysts that cover these companies currently. Most sell-side analysts operate within firms lacking a platform advantage, and by definition, the majority do not rank at the top. This AI generated report could meet that “average” threshold.

Here’s the unedited version of first take report by OpenAI’s Deep Research below. This is text-based. So, you’ll have to image various line charts, bar charts and other graphics that typically are included in sell-side research. It includes the links to the OpenAI Deep Research references. It would be great to hear your take on the AI’s work if you follow the links. Feel free to comment on the article or email me directly.

***Disclaimer: Seriously! It might look like investment research, but this is definitely NOT investment Research and should NOT be relied on for any investment decisions. This is a thought experiment to see how OpenAI’s Deep Research would stack up compared to real investment research. I did not edit anything in the report generated by the AI. The numbers could be wrong, and the facts could be wrong.***

🤖ChatGPT o3-Mini Deep Research:

Take 1: Equity Research Report: Diageo & Pernod Ricard

Executive Summary:

Diageo plc (DGE LN) and Pernod Ricard SA (RI FP) are the world’s leading spirits companies, commanding global portfolios of premium alcohol brands. Both face near-term headwinds from a challenging macroeconomic backdrop – including high inflation, forex volatility, and softer consumer spending – which have recently led to flat-to-declining sales growth and reduced guidance. Nonetheless, long-term industry tailwinds such as premiumization and emerging-market demand remain intact, supporting a gradual recovery. Valuations for Diageo and Pernod have de-rated to multi-year lows (mid-teens P/E multiples) relative to their history, suggesting that much of the bad news is priced in. We recommend a Buy on Diageo and Pernod Ricard, expecting a mid-to-high teens total return over 12 months as earnings stabilize and investor sentiment improves. Our bullish view is predicated on each company’s strong brand franchises, geographical diversification, and potential for margin recovery, balanced against ongoing risks in key markets.

1. Industry Dynamics

Spirits Sector at an Inflection Point: The global beverage alcohol industry is navigating a post-pandemic “reset year,” marked by slowing volumes and shifting consumer behaviors (US spirits face 'challenging' 2025 - The Spirits Business) (US spirits face 'challenging' 2025 - The Spirits Business). In 2024, total alcohol sales growth stalled, with spirits seeing a modest -1% value decline (off-premise) in the U.S. and volume down ~2% (2024 Beverage Alcohol Year in Review - NIQ). This softness followed an exceptional pandemic period where spirits demand surged, leading to excess inventory in the channel. The current environment is characterized by economic headwinds that are tempering demand for high-end liquor, even as longer-term tailwinds like premiumization and innovation persist. Below, we outline key headwinds and tailwinds affecting the industry, followed by a regional breakdown (North America, Europe, China, Rest of World) of consumption trends and outlook.

1.1 Key Headwinds

Macroeconomic & Consumer Pressures: Stubborn inflation and rising interest rates have eroded consumers’ disposable incomes, making pricey “posh spirits” less affordable on a frequent basis (Diageo and Pernod Ricard show ‘challenging’ is the new normal | The Grocer) (Diageo and Pernod Ricard show ‘challenging’ is the new normal | The Grocer). After years of trading-up, some consumers are downtrading or moderating consumption, evidenced by a shift toward “affordable luxury” spirit segments in the U.S. (e.g. $17–$50 bottle range) (US spirits face 'challenging' 2025 - The Spirits Business). In calendar 2024, U.S. spirits volumes fell ~5–6%, reflecting a pullback from the Covid-era spike and weak consumer sentiment (US spirits face 'challenging' 2025 - The Spirits Business) (US spirits face 'challenging' 2025 - The Spirits Business). Europe’s cost-of-living crisis (high energy and food costs) has similarly curbed discretionary spending on premium alcohol.

Destocking in Supply Chains: A pronounced destocking cycle is amplifying the sales slowdown for spirits producers. Having over-ordered in 2021–22 when demand was surging, distributors and retailers in markets like the U.S., Latin America, and China sharply reduced orders in 2023 to normalize inventories (How long will destocking headaches last for fmcg players? | Comment & Opinion | The Grocer) (How long will destocking headaches last for fmcg players? | Comment & Opinion | The Grocer). Diageo, for example, warned that U.S. and LATAM customers paused reorders, contributing to a 20% sales drop in Latin America in late 2023 (How long will destocking headaches last for fmcg players? | Comment & Opinion | The Grocer). This “whiplash” effect is temporary but painful – Diageo had to increase promotions to clear stock, hitting margins (How long will destocking headaches last for fmcg players? | Comment & Opinion | The Grocer) (How long will destocking headaches last for fmcg players? | Comment & Opinion | The Grocer). Destocking has persisted longer than many FMCG firms expected, given high inventory carrying costs under today’s high interest rates (How long will destocking headaches last for fmcg players? | Comment & Opinion | The Grocer). The good news: by H2 2024/H1 2025 there are signs this headwind is easing as channel inventories approach normal levels, although timing remains uncertain.

Forex Volatility: Sharp currency fluctuations are a headwind to reported results. A strong USD in 2022/23 boosted costs for non-U.S. markets and translated into adverse FX for companies reporting in GBP/EUR. Pernod Ricard’s H1 FY25 sales were 6% reported vs. -4% organic, reflecting a €177m FX hit from emerging-market currency devaluations (notably the Argentine peso, Turkish lira, and Nigerian naira) (H1 FY25 Sales and Results | Pernod Ricard) (H1 FY25 Sales and Results | Pernod Ricard). Diageo likewise saw a >£150m unfavorable FX impact in H1 FY24 (2024 Interim results, half year ended 31 December 2023 | Diageo). While some currencies have stabilized, FX remains a swing factor given wide geographic exposure (e.g. any USD weakness would drag on Diageo’s reported growth, whereas EM currency recoveries would help Pernod).

Regulatory & Policy Risks: The alcohol industry faces mounting regulatory scrutiny worldwide. Governments are considering stricter advertising and marketing restrictions (e.g. Ireland’s new alcohol health warning labels in 2023, proposed ad bans in certain jurisdictions) and higher excise taxes to curb consumption or raise revenue. In China, President Xi’s ongoing anti-corruption and anti-extravagance campaigns create a less hospitable environment for luxury spirits gifting and banqueting – a factor behind the slump in high-end Cognac sales (Pernod revises FY outlook after sharp sales drop in China) (Pernod reports sharp -26% sales drop in China - Drinks International). Trade policy flare-ups are another risk: the U.S. last year threatened new tariffs on EU spirits, prompting Diageo to caution that proposed American whiskey tariffs could create “further complexity” in its outlook (Diageo withdraws medium-term sales forecast | WTVB | 1590 AM · 95.5 FM | The Voice of Branch County) (Diageo withdraws medium-term sales forecast | WTVB | 1590 AM · 95.5 FM | The Voice of Branch County). Geopolitical tensions (e.g. EU/U.S.–China relations) also raise the specter of tariffs or import curbs that could hit global alcohol trade.

Supply Chain & Input Costs: Although global supply chain pressures have eased from their 2021 peaks, spirits makers still contend with elevated input costs and periodic shortages. Key commodities (grain neutral spirits, agave for tequila, glass bottles) saw price spikes in recent years. Glass bottle shortages, for instance, forced producers to secure supplies well in advance and at higher cost throughout 2022–24. Elevated logistics and packaging costs have put pressure on gross margins, necessitating price increases which can dampen volume. The industry is managing through, and indeed Diageo noted that its price hikes have offset inflation in absolute terms, but gross margin has still slipped (~-100 bps in FY23) (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener). Supply chain resilience investments (e.g. Diageo’s capex in production & sustainability) should gradually improve cost efficiency, but in the near term margins remain sensitive to input inflation.

1.2 Key Tailwinds

Premiumization & Trading-Up: The decades-long trend of consumers drinking “better not more” is intact, despite a recent pause. Premium-and-above spirits now dominate industry value – Diageo reports ~63% of its sales come from premium-plus brands (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener) (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener). During the pandemic, premiumization accelerated as homebound consumers splurged on top-shelf brands. While 2024 brought a “stall” in trade-up in some markets (U.S. agave spirits growth cooled from torrid levels (2024 and Beyond: Decoding Global Beverage Trends through Data with IWSR’s Emily Neill)), structural drivers remain: a growing mass affluent middle class globally and consumer preference for higher-quality experiences (Diageo and Pernod Ricard show ‘challenging’ is the new normal | The Grocer). Notably, emerging markets are entering a phase where premium spirits are in high demand – e.g. India, Philippines, and Thailand saw “dynamic growth in high-end spirits” even as the global economy wobbled (2024 and Beyond: Decoding Global Beverage Trends through Data with IWSR’s Emily Neill) (2024 and Beyond: Decoding Global Beverage Trends through Data with IWSR’s Emily Neill). IWSR forecasts confirm that premiumization will withstand short-term turbulence and remain a key value driver in the next 5+ years (2024 and Beyond: Decoding Global Beverage Trends through Data with IWSR’s Emily Neill) (2024 and Beyond: Decoding Global Beverage Trends through Data with IWSR’s Emily Neill). We expect both Diageo and Pernod to continue pushing premium innovations and line extensions (limited editions, older age statements, etc.) to capitalize on this enduring trend.

Resilience of Spirits vs. Beer/Wine: Spirits have been gaining share of total alcohol consumption, a positive mix shift for Diageo and Pernod. In the U.S., spirits revenue overtook beer in market share for the first time in 2023 (Spirits sales top beer and wine in 2023 - CNBC), reflecting decades of steady growth. Spirits volumes held up far better than beer or wine during recent downturns – for example, U.S. spirits revenue dipped only ~1% in 2024, while wine fell ~3.5% and beer ~0.7% (2024 Beverage Alcohol Year in Review - NIQ). Spirits’ advantage comes from their broad usage occasions (cocktails, nightlife, at-home), higher aspirational branding, and the ability to command price increases without losing as much volume. Moreover, within spirits, the category mix is favorable: fast-growing segments like Tequila, American whiskey, and Irish whiskey have offset weakness in more traditional categories. (Indeed, Tequila and Canadian whisky were standouts in 2024, still posting growth in an otherwise soft U.S. spirits market (2024 Beverage Alcohol Year in Review - NIQ).) As on-trade venues normalize post-Covid, spirits (especially premium liquors for cocktails) should outpace beer/wine in volume recovery. Overall, spirits’ inherent profitability and premium image provide a cushion in tough times and a tailwind in recovery phases.

Emerging Markets Growth: Developing markets continue to offer a long runway of volume and value expansion. China and India are prime examples: China is already ~10% of global spirits value and, despite current headwinds, is expected to add $42 billion in market value 2022–2027 through premiumization (2024 and Beyond: Decoding Global Beverage Trends through Data with IWSR’s Emily Neill) (2024 and Beyond: Decoding Global Beverage Trends through Data with IWSR’s Emily Neill). India – the world’s largest whiskey market by volume – is seeing rising demand for international brands and higher-end local spirits as incomes rise. Pernod Ricard’s India business grew +6% organically in H1 FY25 even amid global softness (H1 FY25 Sales and Results | Pernod Ricard), with “strong, broad-based growth” across its whiskies (H1 FY25 Sales and Results | Pernod Ricard). Other high-potential markets include Sub-Saharan Africa (young demographics and a shift from illicit alcohol to branded spirits), Latin America (a burgeoning middle class in markets like Mexico, Colombia, Brazil), and Southeast Asia. These regions also benefit the spirits mix: consumers often enter the category via affordable local spirits and then aspire to Western premium brands (e.g., a trend Pernod calls “trading up from local whisky to Johnnie Walker or Chivas Regal”). While emerging markets can be volatile and subject to FX swings, their long-term volume growth (and increasing value via premiumization) is a cornerstone tailwind for the industry. Both Diageo and Pernod have invested heavily to build distribution and local partnerships in these markets, positioning them to reap outsized gains as conditions improve.

Low/No-Alcohol & Innovation: Health and wellness trends are spurring innovation in low- and no-alcohol beverages, turning a potential threat into an opportunity. In 2024, non-alcoholic “spirits” and mocktails gained significant traction – U.S. sales of non-alcohol beers, wines, and spirits neared $1 billion, up double-digits as consumers embrace moderation (2024 Beverage Alcohol Year in Review - NIQ) (2024 Beverage Alcohol Year in Review - NIQ). Rather than cede this space, major players are innovating within it: Diageo was an early mover with its Seedlip non-alcoholic spirit brand, and both companies have launched alcohol-free versions of flagship products (e.g. Gordon’s 0.0% gin, Café Zero by Kahlúa). While still a small fraction of revenue, this segment’s rapid growth broadens the consumer base (appealing to the health-conscious and Gen Z) and provides a hedge against tighter alcohol regulations. Additionally, the rise of ready-to-drink (RTD) cocktails is a related tailwind. RTDs were a notable exception to alcohol’s decline in 2024, continuing to grow and take share (2024 Beverage Alcohol Year in Review - NIQ). Spirits-branded RTDs (canned cocktails, etc.) are booming, leveraging brand equity in convenient formats. Both Diageo and Pernod have invested in RTD capacity and product launches (e.g. Crown Royal and Cîroc canned cocktails by Diageo; Malibu RTDs by Pernod). This innovation pipeline in RTDs and no/low-alc is adding incremental growth on top of the core spirits portfolio.

1.3 Regional Outlook

North America (≈35–40% of sales for Diageo; ~30% for Pernod): The U.S. market is in a hangover phase after an exuberant run in 2020–2022. Retail (off-premise) spirits sales experienced a rare decline in 2024 as inflation-pinched consumers cut back on high-ticket purchases (Liquor Sales Notch Rare Decline In 2024 As Top Shelf Demand Slows). Premiumization trends “stalled” in the U.S. – notably in tequila, which though still growing, decelerated from the explosive ~30%+ gains of prior years (2024 and Beyond: Decoding Global Beverage Trends through Data with IWSR’s Emily Neill) (2024 and Beyond: Decoding Global Beverage Trends through Data with IWSR’s Emily Neill). Instead, U.S. consumers gravitated to cheaper “premium but not super-premium” options (US spirits face 'challenging' 2025 - The Spirits Business). Consequently, industry volumes have dipped: total U.S. spirits volume was down ~3% in 2023 (US beverage alcohol market set for slow recovery after 'reset year') and is forecast to fall another ~5–6% in 2024 (US spirits face 'challenging' 2025 - The Spirits Business) (US spirits face 'challenging' 2025 - The Spirits Business), before stabilizing later in 2025. Within categories, brown spirits (American whiskey, Canadian whisky) and tequila remain relatively resilient (tequila still grew high-single digits in 2024 (2024 Beverage Alcohol Year in Review - NIQ)), while vodka and rum are softer. The on-premise channel recovery (bars/restaurants reopening fully) has helped support tequila and whiskey sales, but a slowdown in home consumption and retailer destocking has overshadowed those gains. For Diageo and Pernod, North America has been a weak spot recently: Diageo’s U.S. organic net sales were roughly flat in FY2023 and turned negative in H1 FY2024, and Pernod’s U.S. sales fell -7% in H1 FY25 (H1 FY25 Sales and Results | Pernod Ricard). Importantly, the sell-out (consumer offtake) trends are better than the sell-in – Pernod noted U.S. consumer demand was around +1% (incl. RTDs) even though its shipments were -7%, implying destocking is a big factor (H1 FY25 Sales and Results | Pernod Ricard). We expect U.S. trends to gradually improve through 2025 as inventories rebalance. Consumer demand in North America should get a mild boost from moderating inflation and low unemployment, though any recession in 2025 is a downside risk. Canada remains a bright spot (healthy growth and share gains, especially in RTDs (H1 FY25 Sales and Results | Pernod Ricard)), and Mexico – a top tequila market – is steady (flat consumer sell-out, even though reported sales dipped) (H1 FY25 Sales and Results | Pernod Ricard). Overall, North America’s short-term outlook is challenging but bottoming: industry leaders foresee the second half of 2025 being better than the first (H1 FY25 Sales and Results | Pernod Ricard), with a return to low-single-digit growth in 2026 under a base-case macro scenario.

Europe (≈20–25% of sales): Europe’s spirits market is mature and showed resilience through the recent downturn, albeit with significant intra-regional variation. In fiscal 2023, both companies posted solid growth in Europe (Diageo Europe +10% org.; Pernod Europe +8% org.) as reopening and pricing offset volume softness. Consumers largely accepted price increases in Western Europe, helping both revenue and margin. However, by late 2023 and into 2024, signs of softness emerged: persistent inflation (especially energy costs) in markets like the UK, Germany, and Spain began to weigh on volume. We are seeing a slight slowdown in Europe’s momentum – Pernod’s Europe sales were -2% organically in H1 FY25 (flat excluding Russia) (Deutsche Bank cuts Pernod Ricard shares target, warns of sales ...), indicating essentially stagnant volume. Southern Europe (Spain, Italy) benefitted from a tourism rebound and resilient on-trade in summer 2023, whereas Northern Europe saw more cautious consumption. Travel Retail in Europe (airports, etc.) had rebounded strongly in 2023, but is now normalizing and faces the comparison hurdle of last year’s surge. A unique European headwind is regulatory action: for instance, Ireland’s new labeling law (first of its kind globally) and Scotland’s debated alcohol ad ban reflect a tougher stance that could gradually dampen marketing effectiveness. On the other hand, premiumization is still evident in pockets of Europe – e.g. demand for single malt Scotch and prestige Cognac remains solid among affluent consumers, and categories like Irish whiskey and gin are growing in popularity. In aggregate, we expect Europe’s spirits consumption to be flat to +1% in the near term (volume declines offset by price/mix). Economic conditions are mixed – while the eurozone flirts with recession, unemployment remains low and wages are rising, supporting some discretionary spend. Diageo and Pernod’s broad brand portfolios position them to weather Europe’s ups and downs: weakness in mainstream brands (say, standard vodka) can be offset by strength in super-premium (craft gin, single malts) sold to higher-income consumer segments. We view Europe as a stable, low-growth region with ongoing margin upside from pricing and cost discipline.

China (High-Single-Digit % of sales for Diageo; ~10–15% for Pernod): China has been a boom-bust story for global spirits. After a sharp rebound in early 2023 post-zero-Covid, the Chinese economy lost steam, and consumer confidence waned. This hit discretionary categories: Pernod Ricard’s sales in China plunged -25% in the July–Dec 2024 period (H1 FY25 Sales and Results | Pernod Ricard), and Remy Cointreau (whose business is ~40% China-driven) saw a similar -30% drop as the mid-autumn festival season disappointed. Two factors are at play: a weak macroeconomic backdrop (youth unemployment, property market stress) and a renewed anti-extravagance sentiment discouraging conspicuous consumption of expensive liquor. High-end Cognac – Pernod’s Martell and Remy’s Louis XIII – has been particularly impacted by reduced gifting and banqueting demand (Pernod reports sharp -26% sales drop in China - Drinks International) (Pernod revises FY outlook after sharp sales drop in China). In contrast, more affordable premium brands (e.g. Pernod’s Chivas Regal Scotch or Ballantine’s, or Diageo’s Johnnie Walker Black Label) are seeing some continued uptake by the growing middle class, though not enough to offset the top-tier decline. It’s important to note that underlying consumer consumption in China likely fell less than shipments, as destocking by wholesalers contributed to the steep sales declines (similar to the U.S. pattern). Looking ahead, we expect China to stabilize over the next 12 months at a lower base. Companies have become more cautious, now forecasting China sales to remain weak for at least a couple more quarters (Diageo and Pernod Ricard show ‘challenging’ is the new normal | The Grocer) (Diageo and Pernod Ricard show ‘challenging’ is the new normal | The Grocer). However, the medium-term outlook is still for growth: China’s younger consumers are developing a taste for Western spirits (especially whisky and rum cocktails), and premiumization in China remains robust – IWSR predicts China’s total alcohol value will grow (+$40bn by 2027) even as volume inches down (2024 and Beyond: Decoding Global Beverage Trends through Data with IWSR’s Emily Neill) (2024 and Beyond: Decoding Global Beverage Trends through Data with IWSR’s Emily Neill). A recovery in consumer sentiment, perhaps via government stimulus or simply cyclical upturn, would unleash pent-up demand in China’s nightlife and upscale dining scenes. One wild card is competition from baijiu (China’s national spirit): it dominates local drinking and is expanding into lower price tiers, which could squeeze foreign spirits at the entry level. Both Diageo and Pernod are responding by localizing – Pernod has introduced a China-specific whisky (“Chuan” malt) and Diageo is building a malt distillery in Yunnan (Challenging China's national drink is tall order for Western liquor ...) – aiming to cater to Chinese tastes. In sum, China is currently a significant drag on industry growth, but we view it as a temporary trough; the market’s size and appetite for premium products make it too important to ignore, and we expect a modest rebound (mid-single-digit growth) in FY2026 as macro conditions improve.

Rest of World (including Emerging Asia ex-China, Africa, Latin America): This diverse segment is the growth engine for both companies, fueled by favorable demographics and rising incomes. India stands out: it is Pernod Ricard’s second-largest market by volume and delivered +6% growth in H1 FY25 despite global headwinds (H1 FY25 Sales and Results | Pernod Ricard). Both Pernod and Diageo (via United Spirits) enjoy leadership in India’s whisky segment and are moving consumers up the value chain (e.g. from local whiskies to imported Scotch). Regulatory quirks (high taxes, advertising bans) make India challenging, but the sheer volume growth (legal spirits volume +5% CAGR expected) and premiumization (a new middle class of ~30 million consumers) underpin a strong outlook. Africa (nearly ~10% of Diageo sales) offers high growth albeit from a low base: Diageo has a deep footprint with local beers (Guinness, Tusker) and mainstream spirits, which saw double-digit organic growth in FY2023 (Pernod returns to growth as China woes ease - The Spirits Business) (Pernod returns to growth as China woes ease - The Spirits Business). Economic volatility (e.g. currency devaluations in Nigeria, South Africa’s slow growth) can cause gyrations year to year, but the long-term trend is one of gradually expanding spirits penetration in Africa. Latin America had a roller coaster: strong post-Covid demand in 2022 gave way to steep destocking in 2023. Diageo’s LATAM sales dropped ~20% in late 2023 (How long will destocking headaches last for fmcg players? | Comment & Opinion | The Grocer), but this is expected to normalize – indeed Pernod noted Brazil returned to growth in late 2024 as consumer demand picked up (H1 FY25 Sales and Results | Pernod Ricard). Key LatAm markets like Brazil and Colombia are recovering from inflation spikes, and young populations there are drawn to international brands (e.g. Buchanan’s Scotch is hugely popular in Latin America). Travel Retail (Global Duty-Free) is another component, comprising high-single-digit percent of sales for Pernod. It had a robust comeback in 2022/23 as international travel resumed, though growth cooled in late 2024 (Pernod’s Global Travel Retail was -9% in H1 FY25) (H1 FY25 Sales and Results | Pernod Ricard), partly due to fewer Chinese travelers. We expect travel retail to remain a valuable channel for premium spirits (lots of impulse luxury purchases in duty-free) and to resume growth as Asia outbound travel recovers. On balance, “Rest of World” markets should deliver the highest growth for the companies over the next 5 years – we model a +6-8% organic sales CAGR in emerging Asia and Africa, versus low single digits in developed markets. Managing volatility and currency risk will be crucial, but both Diageo and Pernod have proven adept at navigating these markets through local talent and agile pricing (e.g. Pernod’s swift price increases in Turkey and Argentina to offset inflation).

Bottom Line: The industry faces a tough near-term road with macro headwinds in North America, Europe, and especially China causing a “new normal” of slower growth (Diageo and Pernod Ricard show ‘challenging’ is the new normal | The Grocer) (Diageo and Pernod Ricard show ‘challenging’ is the new normal | The Grocer). However, underlying drivers like premiumization and emerging market demand provide a safety net and medium-term upside. We anticipate that 2025 will be a year of stabilization – likely a low point for organic growth – followed by re-acceleration in 2026–2027 as comparables ease and consumer conditions improve. The spirits sector historically proves resilient (even in past recessions, volume declines were mild), and current trends such as moderation or trading-down appear cyclical rather than structural. Investors should monitor U.S. consumer health, China’s policy signals, and any destocking progress for cues on timing of the inflection.

2. Company-Specific Analysis

2.1 Diageo plc (DGE LN)

Portfolio & Market Position: Diageo is the world’s largest spirits company, with an unparalleled collection of brands across categories. It owns 200+ brands spanning Scotch whisky (Johnnie Walker, Buchanan’s), vodka (Smirnoff, Ketel One), tequila (Don Julio, Casamigos), rum (Captain Morgan), liqueurs (Baileys), gin (Tanqueray), plus the Guinness beer franchise, among others (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener) (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener). This breadth gives Diageo a balanced exposure to consumer tastes – from fast-growing tequila to resilient staples like Scotch and Guinness – and significant pricing power at the premium end. Over 60% of Diageo’s revenues now come from its “premium-plus” tier brands (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener) (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener), reflecting its success in focusing the portfolio on higher-value labels. Notably, Diageo has pruned lower-margin businesses (e.g. sale of some India brands, disposal of secondary vodka labels) and made bolt-on acquisitions in emerging categories (e.g. premium tequila, Chinese baijiu, ready-to-drink cocktails). This positions the portfolio toward long-term growth segments. By product segment, Diageo generates ~78% of net sales from spirits, 16% from beer (led by Guinness and local African beers), and ~4% from ready-to-drink formats (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener) (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener). The diverse portfolio is a key strength, allowing Diageo to offset softness in one area (say, vodka) with growth in another (tequila), and to cross-sell in markets via its distribution muscle.

Geographic Exposure: Diageo truly has a global footprint – with leadership positions in North America, Europe, Africa, and Asia. Its largest market is the United States (about 28% of net sales by itself (Diageo PLC - 2023 02 21 | PDF - Scribd)), and North America as a whole contributes ~39% (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener) (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener) of net sales. This U.S. tilt has been a boon in past years (strong premiumization trends, high margins), but as discussed, the U.S. is currently a challenging market with destocking. Europe accounts for ~24% (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener), anchored by Great Britain, Ireland, and Continental Europe. Asia-Pacific is ~19%, which includes key markets like China, India, Japan, and Southeast Asia (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener). The remainder is Latin America & Caribbean (~9%) and Africa (~9%) (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener). Profit mix: North America is disproportionately important to operating profit (given ~40% of sales and above-average margins), so the U.S. slowdown has a magnified impact on Diageo’s earnings growth. Conversely, regions like Africa and LatAm are smaller contributors but have been growing nicely (pre-destocking). Importantly, Diageo’s geographic diversity helped it weather the pandemic and other shocks: in FY2023, it delivered growth in 4 of 5 regions, with North America being flat but strength in Europe and Asia offsetting (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener) (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener). Right now, that balance is less helpful because all major regions are experiencing some level of pressure (North America and Asia down, Europe flat). But over a cycle, Diageo’s spread of exposures is a strategic advantage – providing multiple engines of growth and reducing dependency on any single market.

Recent Headwinds & Execution Challenges: Diageo’s FY2024 (year ended June 2024) was weaker than expected, marking the end of a long streak of robust growth. Organic net sales declined ~0.6% (the first drop in years) (Diageo's “challenging” FY24 - key takeaways - Just Drinks). The primary issues were: (a) a sharp slowdown in North America, where shipments were curtailed by destocking and high comparables, and (b) underperformance in Asia (notably China). The company also faced margin pressure from cost inflation and adverse mix. Going into FY2025, new CEO Debra Crew (who took the helm in mid-2023) issued a profit warning and withdrew Diageo’s mid-term guidance of 5–7% organic sales growth (Diageo withdraws medium-term sales forecast | WTVB | 1590 AM · 95.5 FM | The Voice of Branch County) (Diageo withdraws medium-term sales forecast | WTVB | 1590 AM · 95.5 FM | The Voice of Branch County), citing the uncertain environment. This was a significant development – Diageo had long been seen as a steady compounder, so pausing guidance signals that the near-term visibility is limited. Specifically, management is grappling with:

U.S. Destocking “Hangover”: As noted, U.S. wholesalers built up excess inventory in late 2021/2022 (fueled by stimulus-driven demand), which they have been unwinding. Diageo’s high exposure to U.S. spirits made it vulnerable – the company estimates industry depletions (consumer sales) outpaced its shipments by several percentage points in 2023, implying channel inventory reduction. This is a transitory issue, but it raises execution questions: did Diageo overestimate sustainable demand and over-ship? It is now having to recalibrate and work closely with distributors to right-size stock levels. Encouragingly, Diageo signaled that by early 2025, sell-out trends in the U.S. were improving (flat to slight growth) even as sell-in was down, which should eventually translate to normalized ordering (H1 FY25 Sales and Results | Pernod Ricard).

China and Asia Weakness: Diageo’s business in China is smaller than Pernod’s but still important for Scotch and baijiu. The abrupt downturn in Chinese demand (due to macro and anti-graft measures) hurt Johnnie Walker and Shui Jing Fang (its baijiu brand). Additionally, some other Asian markets like South East Asia and Travel Retail slowed in late 2023. Diageo will need to navigate China’s new normal carefully – ensuring brand equity of its premium Scotches isn’t eroded and avoiding overstocking in channels like travel retail. One risk is that if China’s recovery is protracted, Diageo’s prestige segment (e.g. high-end Johnnie Walker Blue Label) could see persistent weakness. The company has responded by increasing marketing support in China and launching white spirits (the planned China whisky distillery is a long-term play to cater to local preferences (Challenging China's national drink is tall order for Western liquor ...)). Execution in China will be key, as it’s a market where Diageo historically lagged Pernod and is trying to catch up.

Innovation Pipeline & RTDs: Diageo’s growth has been aided by a strong innovation track record (flavor extensions, new formats). Recently, however, competition in RTDs and new products has intensified. There is some concern that Diageo needs another hit product akin to Crown Royal Peach or Casamigos RTDs to jumpstart growth in the U.S. market. The company is rolling out offerings (e.g. Cîroc vodka spritz, Captain Morgan cola in a can) and experimenting with lower-alc versions of core brands. While these are promising, innovation comes with execution risk – not every new product will succeed, and consumer tastes are fickle, especially among younger LDA (legal drinking age) cohorts. Diageo must also execute on trends like low-carb or wellness-focused spirits (areas where smaller craft brands have popped up) to ensure it stays relevant.

FX and Cost Management: With the U.S. dollar’s rise in 2022, Diageo enjoyed a translation benefit (since it reports in sterling). That has reversed more recently, with FX swinging to a headwind. Additionally, as mentioned, costs (ingredients, packaging, logistics) remain higher than pre-pandemic. Diageo is working on productivity (it delivered ~£900m in efficiency savings since FY21 through its “fuel for growth” cost programs) and has moderated A&P (advertising & promotion) spend in the short term to protect margins. Nonetheless, execution risk exists if Diageo cuts too deeply on brand investment during a slump – it could harm long-term brand health. Balancing cost discipline with continued brand building is a challenge management is navigating. So far, Diageo has stated it’s maintaining marketing investment, even as it finds other cost levers to pull (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener) (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener).

In sum, Diageo’s current challenges are largely cyclical or self-correcting (destocking, macro slowdowns). The company’s fundamentals – a broad premium portfolio, global reach, and strong free cash flow – remain intact. One notable strategic aspect: Diageo’s acquisition strategy (tequila, craft whiskey etc.) has added debt, but leverage is still reasonable (~2.6x net debt/EBITDA (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener) (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener)) and cash generation is healthy (£1.8bn free cash flow in FY23 (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener) (Diageo : 2023 Preliminary Results, year ended 30 June 2023 -August 01, 2023 at 04:10 am EDT | MarketScreener)). The new CEO is likely to emphasize “back to basics” execution (ensuring core brands perform in core markets) over bold M&A in the immediate term. Investor scrutiny is high given the stock’s underperformance, so all eyes will be on Diageo’s delivery in H2 FY25 and whether trends indeed improve.

Outlook and Opportunities: Despite short-term headwinds, Diageo has multiple avenues for growth. In North America, aside from a normalization of inventory, Diageo can capitalize on growth categories like tequila (Don Julio and Casamigos remain top equity brands riding the agave boom) and Canadian whisky (Crown Royal). The company also sees an opportunity in the U.S. to premiumize further – e.g. pushing more of its “Reserve” portfolio (Ketel One Botanical, Bulleit Bourbon, malts like Lagavulin) as consumers seek craft-like quality from big brands. Internationally, India is a huge opportunity: Diageo’s majority stake in United Spirits gives it access to India’s leading whisky portfolio, and as that market premiumizes, Diageo’s revenue mix in India can shift from value brands to mid-tier and international brands, boosting margins. Africa is another region Diageo is investing in, both in mainstream spirits and local production (for affordability). Moreover, as a leader in digital marketing and distribution, Diageo has been leveraging data and e-commerce (it significantly grew e-commerce sales during the pandemic) – these digital efforts can drive market share gains particularly among younger consumers who purchase online. In short, Diageo’s wide footprint means it can capture upsides wherever they occur. Execution risks persist, but the company’s track record prior to this recent stumble gives some confidence that it can right the ship.

2.2 Pernod Ricard SA (RI FP)

Portfolio & Market Position: Pernod Ricard is the world’s #2 spirits company, boasting a highly complementary portfolio to Diageo’s. Its flagship brands include international best-sellers like Absolut vodka, Jameson Irish whiskey, Martell cognac, Ballantine’s and Chivas Regal Scotch whiskies, Beefeater gin, Malibu rum liqueur, and Champagne marques (Mumm, Perrier-Jouët). Pernod’s portfolio skews a bit more toward whiskies and cognac and slightly less to liqueurs/beer compared to Diageo. Key revenue drivers are Strategic International Brands – the top 12 global brands (Absolut, Jameson, Martell, Ballantine’s, Chivas, etc.) – which make up ~62% of sales (Pernod Ricard lowers annual sales guidance -February 06, 2025 at 01:07 pm IST | MarketScreener). The company also has Strategic Local Brands (~18% of sales) like Seagram’s whiskies in India, Seagram’s Gin in Spain, and other local champions (Pernod Ricard lowers annual sales guidance -February 06, 2025 at 01:07 pm IST | MarketScreener), plus a portfolio of specialty/craft brands (~7%) such as Monkey 47 gin, Aberlour single malt, and other niche labels acquired in recent years (Pernod Ricard lowers annual sales guidance -February 06, 2025 at 01:07 pm IST | MarketScreener). Wines (Jacob’s Creek, Campo Viejo, etc.) are a smaller part (~4%). This mix highlights Pernod’s focus on spirits (over 90% of sales) and its strength in both the premium international segment and important local categories (e.g. Indian whiskies, which Pernod leads). Pernod’s house of brands is well-balanced: it has leadership in whiskey (the Jameson franchise is booming worldwide, and it has a stable of Scotch brands), a solid position in vodka (Absolut remains #2 globally in premium vodka), and a coveted spot in cognac (Martell is one of the “big three” cognacs in China, competing with Hennessy and Remy Martin). Absent from Pernod’s lineup until recently was tequila, but they have invested in that too – Pernod owns Avión and Del Maguey mezcal, and in 2023 took a stake in Código 1530 tequila, recognizing agave’s growth. Overall, Pernod’s portfolio is viewed as slightly less broad than Diageo’s but very strong in its core areas, with a tilt toward ultra-premium brands (its prestige portfolio in cognac and whisky is a high-margin niche).