Framing the Solution: Tracking the Real Impact of Tariffs with Alternative Data (Part I)

A framework for data-driven investing that monitors tariff effects from supply chains to pricing and consumer trends before company results reflect the change.

Trade policy moves in headlines, but its impact flows through shipping manifests, supplier directories, price tags, and ultimately, earnings calls. Tariff policy decisions can trigger operational consequences. For investors and data vendors trying to understand how these shocks materialize across the economy, alternative data1 offers a path to visibility before traditional economic statistics catch up.

What this two-part series covers:

Tariffs trigger economic ripple effects that travel from government announcements through supply chains to company earnings. This two-part series shows how to monitor each step using alternative data—offering a measurable edge before traditional statistics or results catch up.

This series is a guide for tracking the tariff implications. It shows how to break down a tariff shock into its constituent effects and, more importantly, how to use alt data to monitor the real-time economic response across supply chains and sectors. It’s written for readers who want to turn economic behavior into measurable, early insight.

This is Part I of a two-part article that introduces a structured way to monitor the economic effects of tariffs using alternative data. It outlines a seven-step causal framework and focuses on the early signals, policy announcements, supply chain shifts, and freight dynamics. These early signals often appear weeks before official trade or production data. The article runs approximately 3,000 words and is designed to support independent, evidence-based decision-making.

Part II follows the downstream effects of tariff changes. It looks at inventory trends, retail pricing adjustments, consumer behavior, and corporate commentary to show how shocks move through the economy and into company results. It is roughly 3,000 words and is built for readers who want to connect operational data to broader economic outcomes—without relying on lagging indicators.

Welcome to the Data Score newsletter, composed by DataChorus LLC. This newsletter is your source for insights into data-driven decision-making. Whether you're an insight seeker, a unique data company, a software-as-a-service provider, or an investor, this newsletter is for you. I'm Jason DeRise, a seasoned expert in the field of data-driven insights. I was at the forefront of pioneering new ways to generate actionable insights from alternative data. Before that, I successfully built a sell-side equity research franchise based on proprietary data and non-consensus insights. I remain active in the intersection of data, technology, and financial insights. Through my extensive experience as a purchaser and creator of data, I have a unique perspective, which I am sharing through the newsletter.

Disclaimer: The article outlines data-driven solutions to key investment questions. The goal is to help readers frame the right questions and build their own evidence-based perspective using structured analysis and alternative data. This is not investment research. It does not include price targets or recommendations. It doesn’t attempt to answer the investment questions proposed.

Understanding the situation: What’s going on here?

There is a potential scenario that investors are considering that would underpin all fundamental assumptions about economic and company profits. A new paradigm has gained momentum in the world that’s potentially shaping the next 20–30 years of economic trends: protectionism. This is a contrast to the prior 30 years of globalization, which corresponded to an extended period of high growth and redistribution of wealth across the globe.

If this scenario does play out, the relationships between traditional data and financial markets over the last 30 years may mislead investors on what happens next.

These moments when prior causal relationships stop working are when alternative data applied to fundamental analytics typically adds the most value.

The key investment question:

To what extent will the next wave of tariffs structurally alter the earnings power, supply chain design, and pricing strategies of major U.S.-listed companies—and which sectors are under- or over-positioned for that regime shift, relative to consensus2 expectations?

Framing the Solution:

Causal Linking from Government Policy Through to Company Results

To frame a data-driven solution, we break the economic impact of tariffs into a seven-step causal chain. Each link represents a tangible economic behavior or friction point—from the policy shock itself to company-level performance changes. If we can measure each link, we can track the flow of impact in near real time.

Build Monitors Using Alt Data Covering Each Link of the Chain

The overall solution is a Bayesian framework that combines multiple datasets to swarm the debate and create the mosaic. For each link in the chain, there’s a corresponding class of alternative data that can serve as a monitor or early-warning system. Some links may have multiple data solutions. Others may require fusion of multiple feeds. But the goal is the same: to transform policy shifts into measurable firm, sector, or macro-level insights.

Parallels to past worldwide investment debates

A parallel to other major, multi-sector, and geographic events: the global financial crisis that began with the US housing market and the Covid-19 pandemic are prime examples. It doesn’t happen too often in markets where everyone is looking at the same debate. For example, in the Covid-19 example, monitoring outbreaks of cases was step one of an ongoing analytics cycle with alternative data to stay ahead of the lagged economic data and company reporting. No one knew what would happen next, not the governments or companies, so following the data from the early signal through the causal chain is what mattered.

Step 1: Monitor Tariffs and Exposure (Part I)

Economic Mechanism: Track policy as news breaks and assess exposure.

Key Data Inputs: Trade announcements, news feeds, social media feeds, supply chain mapping, and exposure.

Approximate Lag: As news breaks in real time.

Discussed Data Solutions:

Track policy as news breaks, updating the weighted tariff impact model.

Supply Chain Mapping and Exposure.

Step 2: Supply Chain Response (Part I)

Economic Mechanism: Observe shifts in global trade flows and sourcing behavior.

Key Data Inputs: AIS3 shipping logs, port databases, bill-of-lading shifts.

Approximate Lag: +2–4 weeks.

Discussed Data Solutions:

Global Shipping Data to Nowcast4 Trade Flows and Supply Chain Inventory.

Commodity Supply Nowcast.

Company Import/Export Records for Supply Chain Shifts

Step 3: Logistics Tightness (Part I)

Economic Mechanism: Assess stress and adaptation in domestic logistics.

Key Data Inputs: Freight rates and utilization rates, tender rejections, and job listings.

Approximate Lag: +2–4 weeks.

Discussed Data Solutions:

Trucking and Rail Freight Index for Domestic Activity.

Online Job Postings and Labor Market Data for Manufacturing.

Step 4: Wholesale/Distributor Signals (Part II)

Economic Mechanism: Monitor inventory levels and distribution signals.

Key Data Inputs: SKU5 availability, delivery time from resellers, capex6 investments

Approximate Lag: +3–5 weeks.

Discussed Data Solutions:

Web-mined7 Inventory Levels at Retailers and Distributors.

Tracking Domestic Industrial Investment

Step 5: Retailer Adjustment (Part II)

Economic Mechanism: Track pricing shifts and product availability.

Key Data Inputs: Price changes, backorders, SKU deprecation.

Approximate Lag: +4–6 weeks.

Discussed Data Solutions:

Web-mined Pricing (vs. Tariff-Implied Price Change).

Online Price Index for Inflation Nowcasting.

Step 6: Consumer Reaction (Part II)

Economic Mechanism: Analyze real-time consumer behavior.

Key Data Inputs: Sales data, card spending, and best-seller rankings.

Approximate Lag: +1–2 months.

Discussed Data Solutions:

Transaction Data for Tariff-Exposed Consumer Spending

Consumer Price Sensitivity & Substitution Tracking

Web-mined New vs. Used Auto Pricing.

Web-mined Best Sellers—Substitution/Trade-Down.

Step 7: Company Results as a Signpost (Part II)

Economic Mechanism: Observe impact through corporate commentary and financials.

Key Data Inputs: Earnings call transcripts, guidance commentary.

Approximate Lag: Earnings season.

Discussed Data Solutions:

NLP8 on Earnings Calls & News for Corporate Tariff Exposure.

Brainstorm Data Solutions to Address the Key Investment Question

Step 1. Monitor Tariffs and Exposure

Track policy as news breaks, updating the weighted tariff impact model

By now, everyone in the market should be used to the routine. News breaks by social media, an interview, or an official announcement, which marks the various twists and turns of the tariffs being proclaimed by the US and its trade partners. That doesn’t make it less certain, as new geographies, industries, and commodities are stated to have different tariff levels.

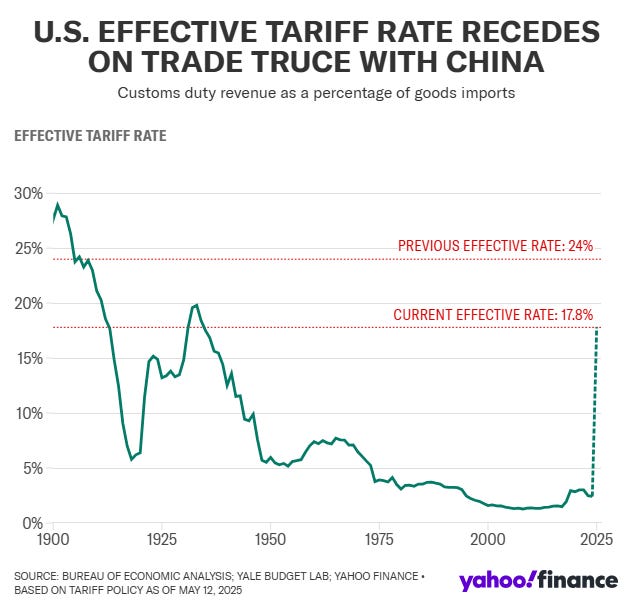

Investors surely have a base model with all the factors weighted into a composite tariff level, which can be compared to historic tariff levels. If Yahoo! Finance has it, surely every asset manager has the same with their own underlying assumptions and scenarios.

When new tariffs are announced, the key questions are: Which products are affected, what are the tariff rates, and when do they take effect?

This is the ground truth. It doesn't tell you what the impact will be, but it tells you where to look. While this link is straightforward, it forms the root node of the causal tree. You can’t measure economic impact without first knowing what changed.

While we could overengineer a solution with alternative data scraping every tweet and news headline and running it through an LLM to translate the messages into real meaning, I think the big headlines are hitting the market right away, with everyone already using traditional methods of consuming the news and interpreting impact. So unless someone is trying to beat the market by milliseconds of reaction time, we’re ok using the traditional approach to monitor the news.

Please note that one must align tariff announcements to effective dates, not just headline timestamps. Some tariffs are phased in; others are contingent on policy negotiations. Some have carve-outs and add-ins. Market expectations matter: if a tariff was long anticipated, its “shock” value may be muted.

The government announcements of tariffs will have an impact on what companies do, which in turn will have an impact on what consumers feel. In addition, ongoing debates about if negotiations will continue, if the governments will back down after posturing a strong hand, or if there is an assumption of a long-term new normal of escalating protectionism will change behaviors.

These behaviors will be measurable using various alternative data techniques that put investors ahead of the company results that will act as signposts for the broader market.

Supply Chain Mapping & Exposure

A graph database of supply links lets investors simulate ripple effects

Investment Question and Use Case

Which firms are overexposed to tariff-targeted regions, and which suppliers are poised to benefit from re-routing? After a new event happens, the immediate next step is to figure out which sectors and companies have the most exposure to the event or change. Before earnings surprises or supply shocks hit the tape, network mapping can expose these vulnerabilities and opportunities—often buried deep in multi-tiered supply chains.

This method is especially relevant in technology, automotive, aerospace, industrials, and any globally interconnected manufacturing ecosystem. It’s also useful for analysts tracking geopolitical shocks, not just tariffs.

Key metrics and analytics approach

Tariff Exposure % of COGS, Revenue, and Other Financial Metrics: Composite percentage based on volume and share of inputs from tariff-hit geographies.

Tariff impact on price if fully passed through: based on tariff rate and % of COGS based on supply chain mapping.

Sector/Geo Risk Index: Aggregated macro risk profiles by industry and region.

Why it works

Tariffs could reshape networks in the long term, but the starting point of the current supply chain network will mean current exposures to an event are factored into the share price first, followed by the post-event reactions to mitigate (or maximize) the short- and long-term impacts. A graph database of supply links lets investors simulate ripple effects: “If China’s inputs go up 25%, which U.S. firms suffer first, and who’s next?”

Caveats and Assumptions

Supply chain disclosed data is messy and incomplete, which requires modeling assumptions to complete the picture. Private firms and smaller nodes are underrepresented. Filings, shipping manifests, and inferred trade flows don’t always reflect criticality. Relationships can be outdated or overstated. This approach assumes tariff impacts will flow through these connections meaningfully and that mitigation options aren’t already in play. Having this work established as a base dataset before supply chain shocks is important. There's no time like the present to establish this foundational database.

Step 2. Supply Chain Response

Global Shipping Data to Nowcast Trade Flows and Supply Chain Inventory

Time series analysis of year-over-year growth in shipping volumes, nowcasting models (regressing current ship traffic on upcoming trade stats), and anomaly detection (to flag sudden drops/spikes around tariff implementation dates).

Investment Question and Use Case

Can we anticipate changes in the trade balance or GDP growth due to tariffs before official trade statistics are released? Are companies front-loading imports or experiencing supply chain bottlenecks due to tariffs, and how might this foreshadow inventory gluts or shortages?

When tariffs hit, companies begin to take steps to mitigate near-term impacts. That may mean accelerating imports, switching ports, or rerouting trade flows. For sectors heavily reliant on cross-border goods, vessel traffic into key ports can signal stockpiling, disruption, or substitution.

Sectors include consumer goods, industrials, tech, retail, and automotive. This approach focuses on geographies such as the U.S., China, and Europe—with an emphasis on import-heavy U.S. ports (Los Angeles, Savannah) and major Asian terminals (Shanghai, Shenzhen). The core data type is AIS (Automatic Identification System) for maritime shipping, which can be enriched with port-level metadata and satellite-derived visual data.