Top questions ahead of Battlefin NYC 2023

Prepare for the upcoming Battlefin conference: spotlighting key questions for panel discussions on generating value from data and technology, while considering quality and compliance.

Welcome to the Data Score newsletter, your go-to source for insights into the world of data-driven decision-making. Whether you're an insight seeker, a unique data company, a software-as-a-service provider, or an investor, this newsletter is for you. I'm Jason DeRise, a seasoned expert in the field of alternative data insights. As one of the first 10 members of UBS Evidence Lab, I was at the forefront of pioneering new ways to generate actionable insights from data. Before that, I successfully built a sell-side equity research franchise based on proprietary data and non-consensus insights. Through my extensive experience as a purchaser and creator of data, I have gained a unique perspective that allows me to collaborate with end-users to generate meaningful insights.

This week, Battlefin is hosting its annual conference in NY on the Intrepid (May 17th and 18th 2023) BattleFin NYC Discovery Day Agenda

For the event, I am sharing key questions on my mind for each panel. There are two broad themes that my questions address:

The evolution of data quality as technology and regulatory environment change

The ability to accurately connect investor outcomes needed with the relevant data and models

Check out the question list below. Let me know what additional questions you would want to ask.

I am looking forward to seeing many of you in person at the event. Feel free to contact me if you’ll be there and want to say hi!

DataChorus LLC business email: jason.derise@datachorus.net

LinkedIn: https://www.linkedin.com/in/jasonderise/

Question List

Day: Day 1

Time: 9:00 AM

Event: Fireside Chat with Walleye Capital and S&P Global: Quant Perspectives on Using Alt Data for Earnings Predictions

Questions: Which approach is more effective: (a) building data driven models by financial line item and then using the basic math of financial statements to derive the answer, or (b) combining all data factors into a model (such as a neural net1) to generate the earnings estimates?

Time: 9:30 AM

Event: The Data Mosaic: Macro Trends for the 2nd Half of 2023

Questions: While the majority of the financial markets will be waiting for the CPI2 release dates, what early signposts should people look for in alternative data sources to understand the probability of the potential inflation level?

Time: 10:00 AM

Event: A Global Perspective: Finding Chinese Datasets with Predictive Power

Questions: How does the panel think about alternative measures for economic growth in China? For example, years ago, many American and European investors believed electric consumption generation was a better proxy for economic growth than GDP statistics.

Time: 10:15 AM

Event: A Global Perspective: What is Happening in China - Current Situations, Regulations and Compliance

Questions: What precedents have been set in the interpretation of the data protection laws as it relates to alternative data sources? Which currently developing situations should be monitored to get a sense of future standards?

Time: 10:30 AM

Event: Deep Dive on Web Scraping, ChatGPT and Recent Learnings from SEC Exams

Questions: Under compliance with the policies of SEC Section 204A3 related to Alternative Data, what were the most commonly found areas of poor policy implementation?

Time: 11:00 AM

Event: New Data Product Showcase

Questions: Data/ai launched a new Total Revenue product. I’d be curious to learn more about the methodology of combining data sources into their revenue estimates. What business or app types have the best accuracy, and which ones have a higher margin of error, variance, and bias?

Time: 11:10 AM

Event: Data Sourcing and Strategy Panel

Questions: I’m curious to see how the pane’s approach compares to my approach outlined here:

Time: 11:40 AM

Event: Keynote: Keeping up with Innovations in AI & Machine Learning, a CTO perspective

Questions: In the future, Where can systematic investing be improved by generative AI? What aspects of systematic investing can be replaced by generative AI?

Day: Day 2

Time: 9:00 AM

Event: Leveraging clickstream data for Financial Services and Corporate use cases

Questions: Clickstream data may be well understood by the financial community for high-profile use cases, but which potentially high impact use cases are being underutilized by investors?

Time: 9:30 AM

Event: How Private Equity Firms Use Alt Data and AI

Questions: Of the 3 ways PE firms4 use alt data (Using Data for Deal Sourcing, Due Diligence, and Enhancing Portfolio Companies), which has the biggest gap between current use and impact versus its potential impact?

Time: 10:00 AM

Event: The Data Mosaic: Technology & Software: SaaS Trends: Are we back to normal from the Semi Shortage?

Questions: As a thought exercise, if we were to set a hypothesis that semiconductor inventory and demand are back to equilibrium, what data points would we use, and how would we test if they are?

Time: 10:30 AM

Event: Using ChatGPT Technology to Revolutionize the Data Sourcing Landscape?

Questions: How will data quality be managed in when Large Language Models (LLM) are prone to hallucinations? What is the model to test the model is accurate and can testing be done at scale or redundant or manual checks?

By the way I used Google Bard to do a small web scraping exercise to get the agenda and format into a table … it missed one of the entries on Day 1 and hallucinated half of day 2. Ironically, it completely missed this agenda item.

Time: 10:45 AM

Event: Data Mosaic Real Estate Trends Rebound or Apocalypse

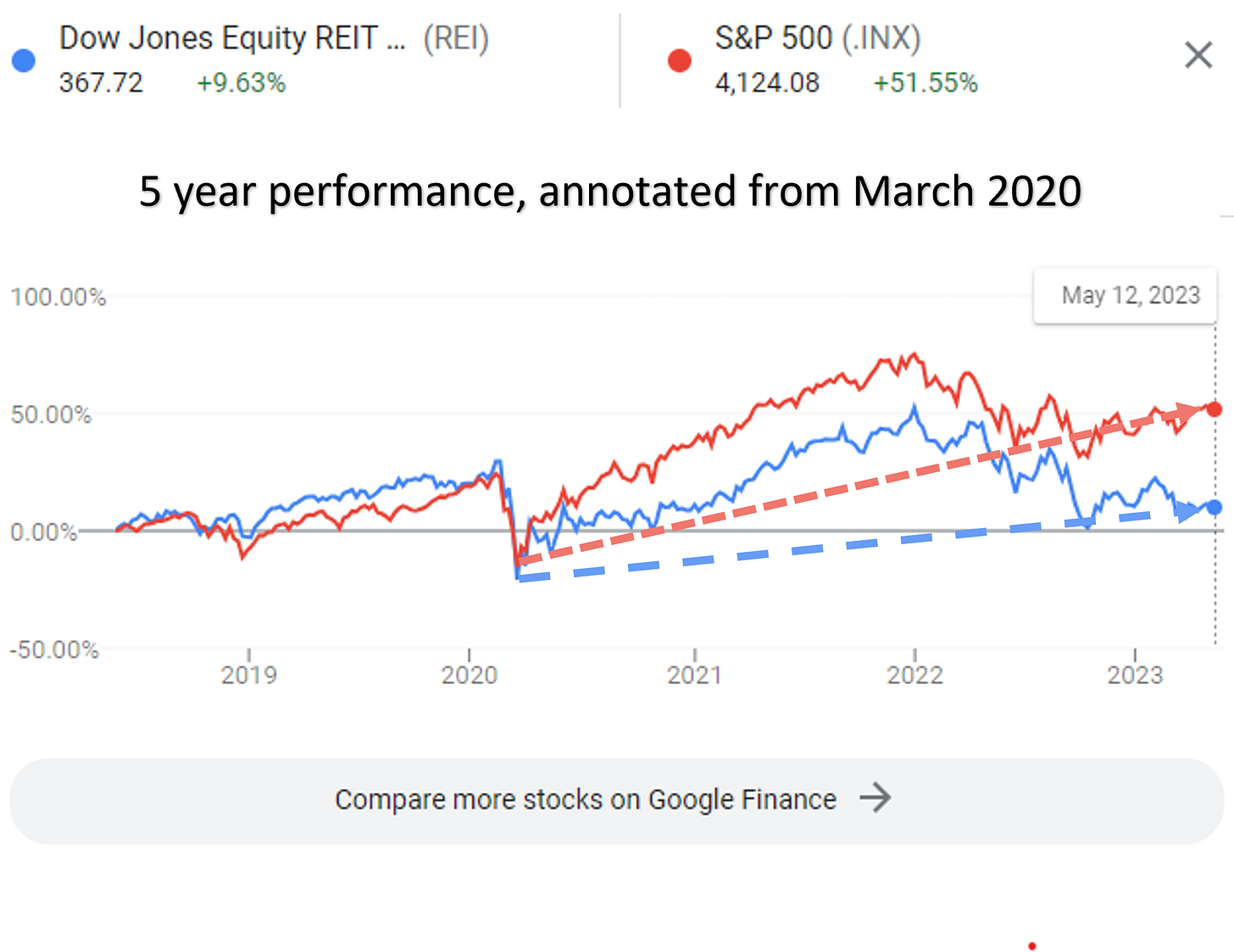

Questions: The pains of the office Real Estate Investment Trust (REIT) fundamental situation have been well documented since 2020. However, the share prices did not immediately reflect this reality (judging by their continued relative underperformance vs the overall market through to present day). Perhaps it’s a case of “The hope that kills”. But, with the benefit of hindsight, what data points over the last 3 years would have revealed the current difficult situation? And then, looking forward 3 years, what data points should be monitored to know that the rebound is happening?

Time: 11:15 AM

Event: New Data Provider Showcase

Questions: No agenda at the time of drafting this, but I’m keen to see the latest and greatest! :)

Time: 11:45

Event: Corporate & PE Use Cases: How Corporations Can Use Alternative Data for Competitive Intelligence and Tracking the Customer Journey. How PE firms use alt data for comparing deals and diligence. How Data Providers sell to both Corporate and PE firms. What works and what doesn't.

Questions: How important are Environment, Social, Governance (ESG) datasets in the process of assessing long-term risks and opportunities for both PE firms and corporates? Perhaps as a multiple choice option Is ESG data “Interesting”, “Nice to have” or “Critical” in the process?

Think this is useful for someone attending Battlefin? Feel free to forward it on.

What questions would you ask? Leave a comment.

Like the content and what to get the newsletter straight to your email?

-Jason DeRise, CFA | jason.derise@datachorus.net | https://www.linkedin.com/in/jasonderise/

Neural Net: Refers to artificial neural networks, a subset of machine learning models inspired by the human brain. They can learn and improve from experience, adapting to new inputs without being explicitly programmed to do so.

Data Protection Laws: Legislation intended to protect individuals' personal data in the context of professional or commercial activity. An example is GDPR (General Data Protection Regulation) in Europe.

Section 204A: Refers to a section of the Investment Advisers Act of 1940 in the United States, which concerns codes of ethics and internal compliance procedures.

PE firms: Short for Private Equity firms, which are investment management companies that provide financial backing and make investments in the private equity of existing or startup companies either not yet listed on financial market exchanges or taking ownership of the company and removing its public market equity.