Using Alternative Data for long-term investment debates: Tesla thought exercise

Myth: Alternative Data is only valuable for predicting the upcoming quarter. Fact: Alternative Data can be used to improve long-term forecasts in addition to near term forecasts.

Welcome to the Data Score newsletter, your go-to source for insights into the world of data-driven decision-making. Whether you're an insight seeker, a unique data company, a software-as-a-service provider, or an investor, this newsletter is for you. I'm Jason DeRise, a seasoned expert in the field of Alternative Data insights. As one of the first 10 members of UBS Evidence Lab, I was at the forefront of pioneering new ways to generate actionable insights from data. Before that, I successfully built a sell-side equity research franchise based on proprietary data and non-consensus insights. Through my extensive experience as a purchaser and creator of data, I have gained a unique perspective that allows me to collaborate with end-users to generate meaningful insights.

Myth: Alternative Data is only valuable for predicting the upcoming quarter.

Fact: Alternative Data can be used to improve long-term forecasts in addition to near term forecasts.

Don’t get me wrong, there’s huge value in finding proprietary data sets that have predictive power in forecasting upcoming results or nowcasting a widely followed economic indicator. Most common is institutional investors using consumer credit card transaction data to predict revenue growth of consumer facing businesses. And many other dataset types have been shown to have predictive power for short term forecasts.

However, if you need to answer longer term questions in your investment process, Alternative Data is also highly effective.

“All models are wrong, but some are useful” is the often referred to quote, attributed to British Statistician, George Box.

The key is taking a Bayesian approach1 to the long-term question and answers. No single data set can predict 4-8 quarters ahead because the actual results are heavily influenced by other factors beyond a single dataset and are dynamically changing. Single point estimates will be wrong in the long term (or right by some small probabilistic chance). “All models are wrong, but some are useful” is the often referred to quote, attributed to British Statistician, George Box.

What do fundamental long-term investors do to decide on an investment? They take in lots of data points, anecdotes, analogies, and any other potential factor on long-term performance as feedback about the economy, industry, companies, governments to create a vision of the future in order to invest based on that thesis.

How will they know their long-term view is right? They look for reasons to continue to believe their view or change to a new view as they monitor reported results, talk with management, talk with experts, monitor traditional data sources and so on. Alternative Data should be put through that lens to provide new confirming or disproving insights of their long-term view.

This is the art of investing based on proven frameworks that work. But statistically speaking, its really a Bayesian approach to setting an estimate benchmark and recalibrating as new information becomes available. Alternative Data should be added to the mosaic to improve the ability get the probabilities of outcomes right.

A thought exercise using Tesla as an example

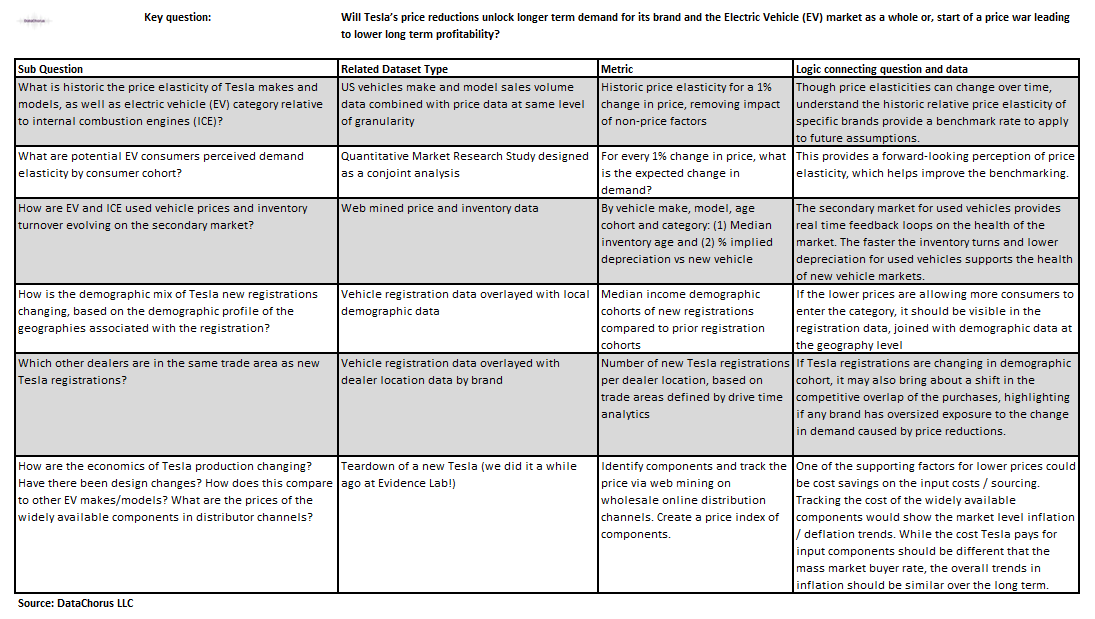

Will Tesla’s vehicle price reductions unlock longer term demand for its brand and the Electric Vehicle (EV) market as a whole or, start of a price war leading to lower long-term profitability?

Instead of using past case studies where data showed an impact on long-term debates, I thought it would be more helpful to think this through with a current investment debate, which cannot have a known conclusion today- only in the future will the answer reveal itself.

Let’s use Tesla’s recent price reductions2 as a catalyst to assess the situation and design an approach to using Alternative Data to address the likely long-term outcome.

A key question on investor’s minds after the results is: Will Tesla’s vehicle price reductions unlock longer term demand for its brand and the Electric Vehicle (EV) market as a whole or, start of a price war leading to lower long-term profitability?

My approach:

Break this unanswerable big question into smaller, more answerable questions, where the answers can be measurable. The future answers to the questions need to be able to pass this logic test: “if I had the answer to this question, would I be able to better estimate the answer to the bigger question?”

Decide on the datasets and metrics that can answer the questions. More specifically the answers can be observed by collecting data on consumer and corporate behaviors, related to the specific questions.

Set an expected long-term view for each metric and what it means for the answer. State why the metric relates to the question and the logic of why it’s supporting or disproving of the view. This is so important to fight future cognitive biases when the data is disproving.

Execute on the ETL/ELT3 (extract-transform-load or extract-load-transform), cleansing, enriching the data to derive insight ready metrics.

Create ongoing production of data pipeline to push intelligence to decision makers, tracking the metrics vs benchmarked expectations.

Recalibrate your long-term forecast and probability of its accuracy as new information is available; Is the outcome more or less likely to occur? Also continue to assess if the question is still the right question to answer.

Fellow insight seekers - How does your approach to this differ and where are we the same?

Let’s apply the first 3 steps to the key question:

But first - a quick heads up on my approach here. I’m not going to take an actual view on this debate, and I feel the need to make it clear this isn’t a research report. I am simply going to frame the debate and potential solutions.

To aid this discussion, I will state a hypothesis to test. “Tesla’s price reductions will expand the size of the EV market and Tesla’s market share within it over the next 3 years” - Again, I’m not agreeing or disagreeing with the statement, I’m stating the view to be tested with Alternative Data.

Also, as I figure out the depth of discussion in this newsletter, I may end up either going too deep or too shallow on a topic versus what my readers want (please let me know). In this entry into the newsletter, I’m not going to specifically name data partners or get into the details of how to turn that specific dataset into an insight / share code, etc. More important to this specific newsletter entry is that it makes a practical case for the value of Alternative Data in addressing long-term debates.

And one more side note… couldn’t find an obvious way to create tables within the text on substack. So, I decided to take an image of the table I created. And, instead of showing all the questions I brainstormed, I’ll just show the first few rows since its going to get hard to read the table. Not letting great become the enemy of good.

I added some footnotes defining jargon in the table4

As I mentioned, I left out about half of the ideas for applying Alternative Data to long-term questions. What else should have been in the table?

This approach can be a benchmark for investment professionals and data businesses to assess their own approach to identifying long-term investment debates, breaking it down into its smaller components and selecting the most relevant data metrics to answer the questions. Good questions and good research lead to even better questions and better research.

How does this compare to your approach to connecting data with long-term decision outcomes?

Fellow insight seekers - do you have a different process for identifying opportunities for data to generate actionable insights?

Follow data creators - do you go through a similar exercise with high profile investment debates to think through how to position your data products effectively to show its impact potential?

- Jason DeRise, CFA

Bayesian approach: A statistical method that updates probabilities based on new data, incorporating prior beliefs and evidence to form updated conclusions.

Lots of reference articles to choose from, but here’s one: https://www.latimes.com/business/story/2023-04-25/ev-price-war-tesla-drops-the-model-y-starting-price-below-the-average-u-s-vehicle-cost

ETL/ELT: Extract-Transform-Load and Extract-Load-Transform are processes in data integration to prepare data for analysis by extracting it from source systems, transforming it into a useful format, and loading it into a target system.

Defining some jargon in the table:

Conjoint analysis: A survey-based market research technique used to understand how consumers value different features of a product or service.

Vehicle registration data: Data on the registration of motor vehicles, often including details like make, model, year, and owner demographics.

Trade area: A geographic region where a business draws a majority of its customers from, usually defined by factors such as distance or drive time.

Teardown: A detailed disassembly and analysis of a product to understand its components, manufacturing process, and costs.

Web mining: The process of extracting useful information from web data sources, such as web pages, server logs, and search engines.

Great coincident timing - check this out to go deeper on one of the ideas discussed.

https://substack.com/profile/42673781-pierluigi-vinciguerra/note/c-15311289