Framing the Solution: Which food and beverage companies still have pricing power after half a decade of high inflation?

How traditional data, alternative data and advanced analytics can come together to answer the question.

Over the past five years, US food and beverage, consumer packaged goods (CPG) companies have navigated one of the most inflationary periods in decades. Initially, raising prices was a straightforward response—cost of goods sold (COGS)1 went up, and companies passed them along to consumers. For a while, it worked. But as inflation persisted consumer budgets tightened, and the landscape may have shifted.

Will companies still be able to push through price increases without losing market share? Or has pricing power peaked, forcing some brands into trade-offs between margins and volume? Which food and beverage companies still have pricing power after half a decade of high inflation?

Some food and beverage companies will retain pricing power despite prolonged inflation, but others will face margin pressure. This article outlines how data can help determine which companies fall into each category.

Traditional financial data alone won’t be enough to answer the question. Alternative data2 can help investors assess which companies in the food and beverage sectors still have pricing power after a long period of high inflation. The article outlines a multi-layered analytical approach that combines financial data, government data, point-of-sale (POS) data, consumer survey data, card transactions, and web analytics. By integrating these insights, we can move beyond historical earnings reports and build a real-time understanding of pricing power across the sector. Alternative data does not replace traditional financial analysis—it enhances it by providing early signals on pricing strategies and consumer responses before they appear in earnings reports.

This isn’t an investment research report; This article is not going to share answers to the key investment question — but this article will help you think through the problem to run your own analytics with alternative data.

This article aims to help both financial professionals and data professionals think through how data could be used to answer big uncertainties in the market. The investment question we break down into a practical set of datasets and analytics is “Which food and beverage companies still have pricing power after half a decade of high inflation?”

To determine which companies still have pricing power, we need to assess key dimensions:

The industry-wide cost absorption vs. pass-through leveraging government data

Corporate pricing strategies based on operating and pricing leverage, compared to price elasticity using a mix of traditional data, alternative data, and analytic techniques.

Real-time monitoring of the consumer response to price changes using various alternative data sets.

I would note that this use of advanced analytics and alternative data isn’t about predicting the next quarter more accurately than the market. This is a long-term debate that’s broken down into its key components, understanding the corporate strategy and practical constraints to implementing that strategy successfully to set a baseline view of which companies can continue to increase prices.

Welcome to the Data Score newsletter, composed by DataChorus LLC. The newsletter is your source for insights into the world of data-driven decision-making. Whether you're an insight seeker, a unique data company, a software-as-a-service provider, or an investor, this newsletter is for you. I'm Jason DeRise, a seasoned expert in the field of data-driven insights. As one of the first 10 members of UBS Evidence Lab, I was at the forefront of pioneering new ways to generate actionable insights from alternative data. Before that, I successfully built a sell-side equity research franchise based on proprietary data and non-consensus insights. After moving on from UBS Evidence Lab, I’ve remained active in the intersection of data, technology, and financial insights. Through my extensive experience as a purchaser, user, and creator of data, I have gained a unique perspective, which I am sharing through the newsletter.

Understanding the situation: What’s going on here?

Before we look ahead with the key investment question, “Which food and beverage companies still have pricing power after half a decade of high inflation?” It’s important to understand what’s going on right now as context for the investment question.

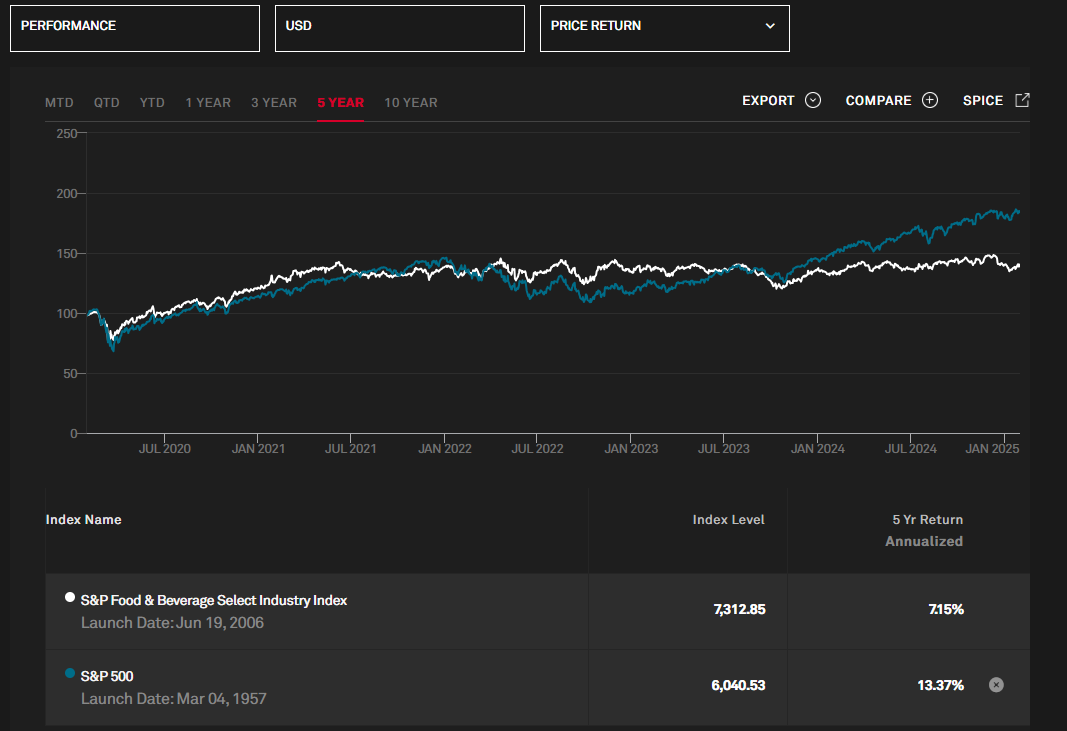

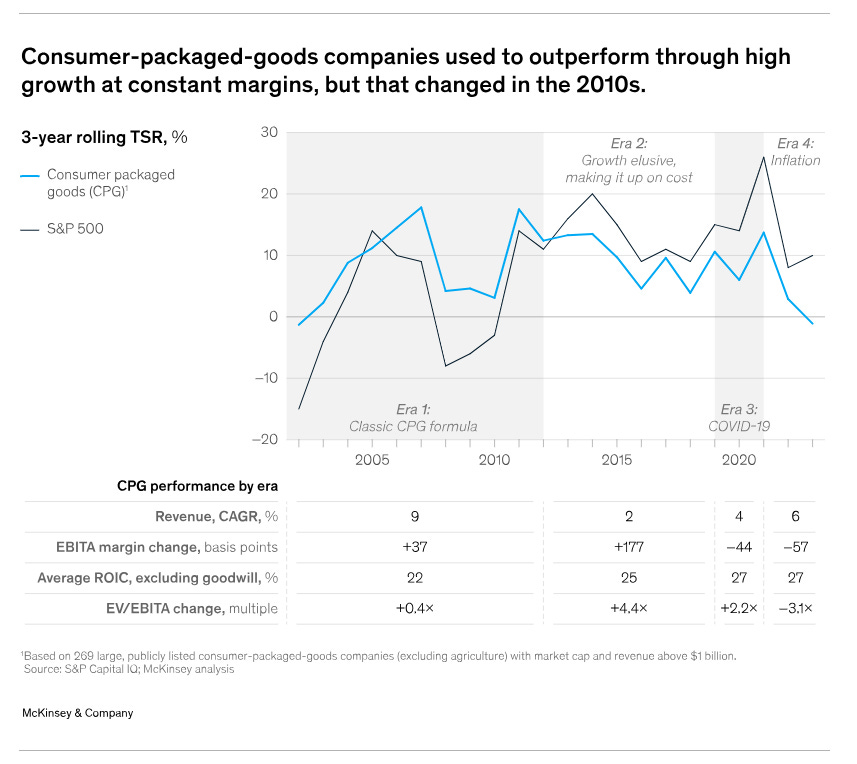

The US Food & Beverage Consumer Packaged Goods sector historically generated results driven by growing organic volume growth, organic price and mix effects3 leading to organic revenue growth, with profits being driven by growth. However, as growth slowed, cost cutting became more important as a driver. In the most recent years, high food & beverage price inflation became the primary driver of revenues but led to margin pressure and organic volume declines. During the initial period of high inflation, food & beverage companies performed strongly in the markets but have since stalled in absolute terms and have underperformed the S&P 500 in relative terms.

In 2021, U.S. food and beverage inflation surged to levels unseen since the late 1970s. Prior to the recent spike in inflation, the sector benefited from mostly below-historic average inflation.

Since 2010, inflation ebbed and flowed, but the pandemic and supply shocks plus economic stimulus led to high inflation.

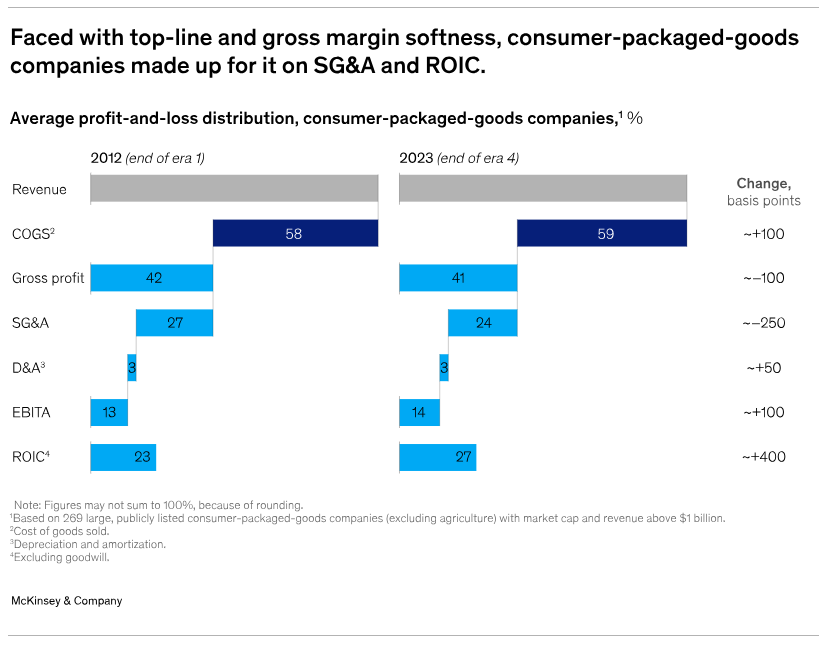

The McKinsey analysis below shows that gross margins were under pressure during this latest period of high inflation. The full inflation was not passed along to consumers, which can be seen in the gross margin contraction (cost of goods sold grew faster than revenue).

In addition, organic volumes declined. Note the revenue CAGR is below the CPI trends shown above. Comparing revenue growth to food & beverage CPI inflation as a rough proxy highlights shifts in volume growth. A simple estimate subtracts CPI inflation CAGR from revenue CAGR, though mix effects also matter.

To mitigate the impact, CPG companies reduced SG&A costs4 and improved capital efficiency.

The key investment question: “Which food and beverage companies still have pricing power after half a decade of high inflation?”

For a time, all companies could raise prices without significant consumer pushback. However, it’s unknown if consumers can continue to accept future price increases should more price increases be on the horizon due to geopolitical implications due to tariffs and/or supply constraints.

“Which food and beverage companies still have pricing power after half a decade of high inflation?” One possible scenario is that all companies can raise prices again without a material impact on market share or volume growth. However, some companies may face volume and market share losses. The industry faces a trade-off: raising prices to protect margins risks losing market share, or holding prices steady to grow market share at the expense of profitability.

This isn’t an investment research report. So, I won’t take a view on the answers to these questions or share what the answers would mean for an investment decision. Instead, I explain how I would approach the problem. Others in the community are welcome to share their opinions and data or the answer to the key question in the comments.

Brainstorm data solutions to address the key investment questions

Price sensitivity, operating leverage5, and cost of goods sold (COGS) inflation exposure collectively shape a company's likely pricing strategy. While an investor can’t rule out illogical behavior by corporations, knowing the logical game theory in advance helps narrow the possibilities.

Begin with traditional data to reverse-engineer each company's probable strategy. With that insight, we can make a much better-informed hypothesis about who will be able to pass on higher prices in the coming quarters and years, which we can then test by monitoring alternative data.

The 8 brainstormed ideas discussed in detail are:

Analyzing Cost Absorption

Operating and Pricing Leverage

Tracking Price Elasticity

Predicting Consumer Trade-offs and Willingness to Pay

Understanding Market Segmentation

Core Point of Sale Transactions Analytics

Card Transaction Data

Web-Mined Best Seller and Pricing Data