When Washington Goes Dark, Alt Data Companies Can Shine

Government shutdowns can halt official stats, but alternative data can keep markets informed.

A U.S. government shutdown does more than halt paychecks and public services. It also cuts off the nation’s most trusted flow of economic data. Without monthly updates on jobs, inflation, and consumer spending, markets face uncertainty. This disruption creates a clear opportunity: alternative data can fill the gap and provide investors and policymakers with the signals they need.

In this article, I outline:

How different categories of private data can serve as proxies for key government statistics

The strengths and weaknesses of these alternatives

What data companies can do to turn a shutdown into long-term visibility and growth

Welcome to the Data Score newsletter, composed by DataChorus LLC. This newsletter is your source for insights into data-driven decision-making. Whether you’re an insight seeker, a unique data company, a software-as-a-service provider, or an investor, this newsletter is for you. I’m Jason DeRise, a seasoned expert in the field of data-driven insights. I was at the forefront of pioneering new ways to generate actionable insights from alternative data. Before that, I successfully built a sell-side equity research franchise based on proprietary data and non-consensus insights. I remain active in the intersection of data, technology, and financial insights. Through my extensive experience as a purchaser and creator of data, I have a unique perspective, which I am sharing through the newsletter.

The connection between a government shutdown and data

A prolonged U.S. government shutdown creates an economic data desert. Agencies such as the Bureau of Labor Statistics (BLS), Census Bureau, and Commerce Department normally publish gold-standard indicators on employment, inflation, retail sales, and GDP. During a shutdown, these agencies furlough most staff and cancel or delay releases. Without these reports, investors struggle to gauge the economy, and volatility tends to rise.

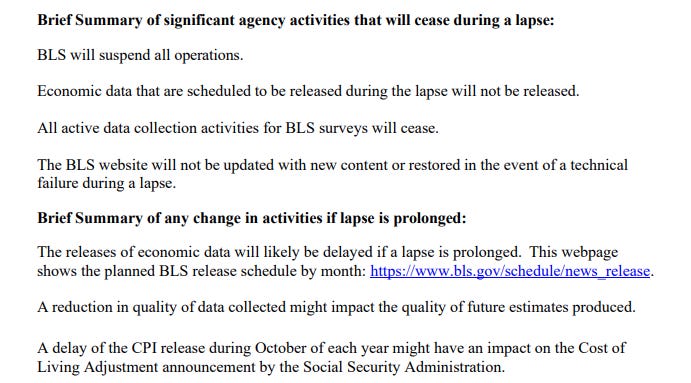

An extended shutdown accelerates demand for alternative data. Investors, central bankers, and companies will increasingly rely on private sources—from payroll processors and consumer‑transaction feeds to satellite imagery—to bridge the data vacuum. In previous shutdowns, the monthly Employment Situation and consumer‑price reports were delayed by two weeks in 2013 and nearly a month in the 2018–19 shutdown. The BLS may cease all data collections if funding is lapsed as outlined in its contingency plan published on September 26, 2025.

In the potential void is an opportunity

There is an opportunity for data companies to fill the void by publishing macro views of their datasets, which can help the greater market but also generate positive publicity, awareness, and understanding of their unique methodologies.

In 2020, during the economic uncertainty caused by the Covid-19 pandemic, many companies published datasets to provide guidance. Companies with access to mobility data created highly aggregated, anonymized metrics to show how populations were either isolating or returning to business as usual. My former employer, UBS Evidence Lab, made our datasets available to the press for free in 2020 to help with their coverage of the pandemic with real data points.

In this brief article I highlight potential ways alternative data can fill the gap in US government statistics should a shutdown continue long-term.

Mapping alternative data to key government statistics

Employment Data

As a very recent example, Revelio Labs has leveraged its proprietary jobs market data to create publicly available metrics that track changes in employment, job openings, employee hiring and attrition rates, and salaries from new openings.

This approach allows companies to share high-level metrics without disrupting their core businesses, while enabling users to dig deeper into the data for investment insights. The high-level macro statistics are unlikely to cannibalize its own business. Even for those who are using the data to model macro outcomes, each investor likely uses a different combination of factors and techniques to generate their estimates. However, the primary benefit of Revelio’s data is the depth and frequency with which it is made available, allowing for many more investment use cases. Other data companies can follow this example.

Inflation Data

The absence of official inflation data challenges monetary policy management and complicates asset managers’ assessment of future interest rates. However, pricing data is available from multiple sources covering many consumer and business-to-business industries, which can help users of the data monitor pricing across many categories.

There are multiple sources of pricing data across the alternative data landscape, including:

Web-mined pricing data of consumer and business products and services

Receipt-level transaction data for consumer sectors

Web-mined housing price data

Scanner data, which covers revenue and volume data, can be converted into average demand-weighted prices (i.e., including mix effects).

Exhaust data from companies within the supply chain (e.g., published shipping rates).

Some of these dataset types are covered in prior Data Score articles.

The dataset deep dive on web-mined pricing shows how to get insights on apparel inflation, but the same approach can be applied to other categories.

In the second part of the series on monitoring the impact of tariffs, I outlined datasets that could help monitor downstream implications, which included multiple approaches to monitoring inflation.

I also outlined how pricing power could be monitored at the company level, which also provides ideas about how to aggregate to industry-level signals.

Consumer Demand Data

The majority of the US economy is driven by consumer spending; therefore, tracking consumer demand with multiple data sources can help understand the key drivers of GDP growth.

Credit card transaction data

Receipt-level transaction data

Foot traffic data

Web traffic data

App Usage data

Each of these dataset types can be aggregated into industry-level and national proxies for consumer demand.

I discussed how to combine these datasets to assess individual company results, but the same logic could be applied to aggregate metrics across all consumers in the US.

Industrial and Commodities Activity Data

To understand the industrial and commodities sector contribution to demand, there are fewer options available across the alternative data landscape. However, enough data exist to get a strong proxy.

AIS Shipping data

Construction permit data

Web-Mined Inventory data

Industrial Nowcasting data

Remote sensing data on health of crops

Earlier this year, I discussed upstream alternative data indicators tied to rising tariffs. These datasets can also be adapted to monitor broader industrial demand.

The shipping data deep dive outlines methods for converting raw AIS data into actionable signals.

I discussed a good use case for satellite data for crop yield monitoring:

Caveats to consider

Alternative data is not a perfect substitute for government statistics. Many datasets suffer from coverage bias; for example, the well-established ADP payroll data covers only private employers who use ADP’s services and may under‑represent small firms or sectors. Web-mined job listings might not reflect high‑salary professionals found through outsourced recruiting firms. Credit card data has multiple demographic biases depending on the provider and, by definition, omits cash transactions.

Government data collection and methodologies also contain biases. For example, the CPI approach to housing introduces multiple calculation choices that lead to a delayed impact to the index from current month housing cost changes. Even indicators like the PMI are survey-based and therefore introduce potential noise and bias in the collection process.

Users of alternative data need to consider the detailed due diligence process to decide if alternative data can be a proxy for government data sources or if the data source is a complementary indicator instead of a substitute.

Not all alternative datasets may be robust enough to replace official measures. However, in the absence of official data, complementary signals are preferable to anecdote and assumption.

Concluding thoughts

Historically, government shutdowns have been short and have had minimal long‑term impact on financial markets. Nevertheless, repeated episodes can serve as catalysts for structural change. Each data vacuum trains investors and policymakers to rely on alternative sources, integrating them into previously rigid investment decision frameworks.

Over time, investors will likely give even greater weight to high‑frequency alternative data and machine‑learning models, shifting the information advantage toward firms that can process these signals.

For alternative data providers

Consider offering a highly aggregated but helpful view of your data to the market for free during periods of US government disruption. I believe this is a positive driver of awareness and adoption and not a source of cannibalization. Reserve company-level, more granular, and higher-frequency data for paying customers.

Demonstrate value and reliability by showing how your datasets align with official indicators and deliver early insights during data vacuums. Publish transparent white papers documenting methodologies, coverage, and correlation with government data.

Engage with regulators. Even during a shutdown, maintain dialogue with agency staff and industry associations. Participate in public consultations and help shape future regulatory frameworks for alternative data.

Design flexible pricing models. Offer tiered subscriptions or pay-per-use services to broaden the customer base and reduce reliance on a few large clients.

The window may be short for this shutdown, but history shows repeated episodes of shutdowns and threats over the past decade. Efforts to cut government costs may also affect data collection going forward. It’s worth taking the opportunity now to establish a strategy to fill the void.

Data Providers: What other datasets should investors and policy makers consider incorporating if there an outage for US government statistics? Leave a comment below.

If this article is useful, feel free to share it.